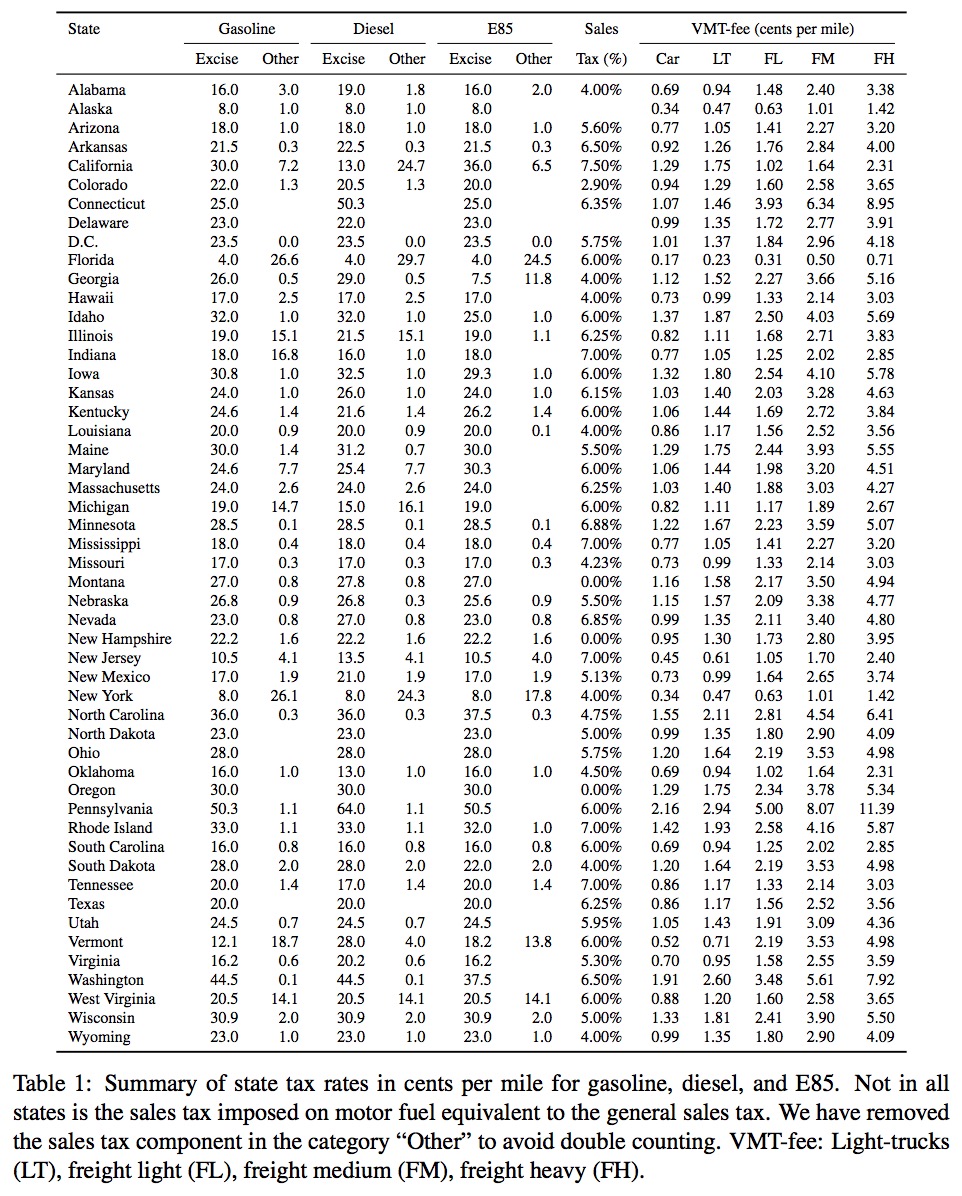

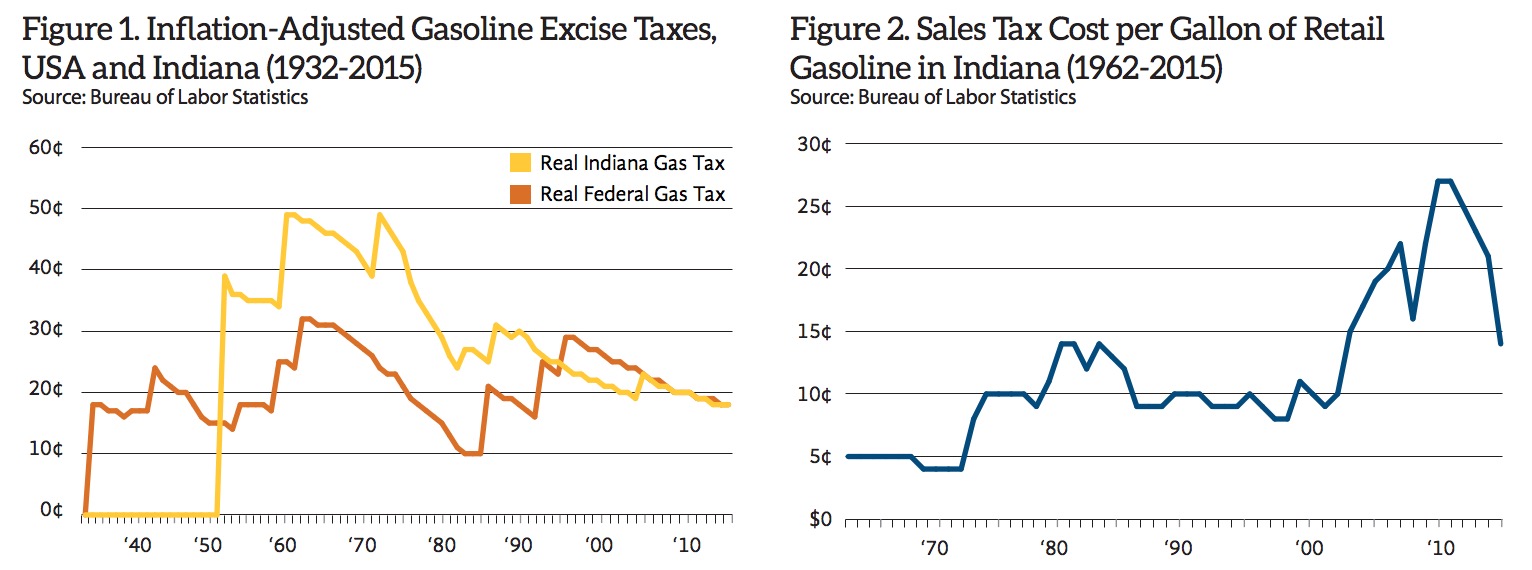

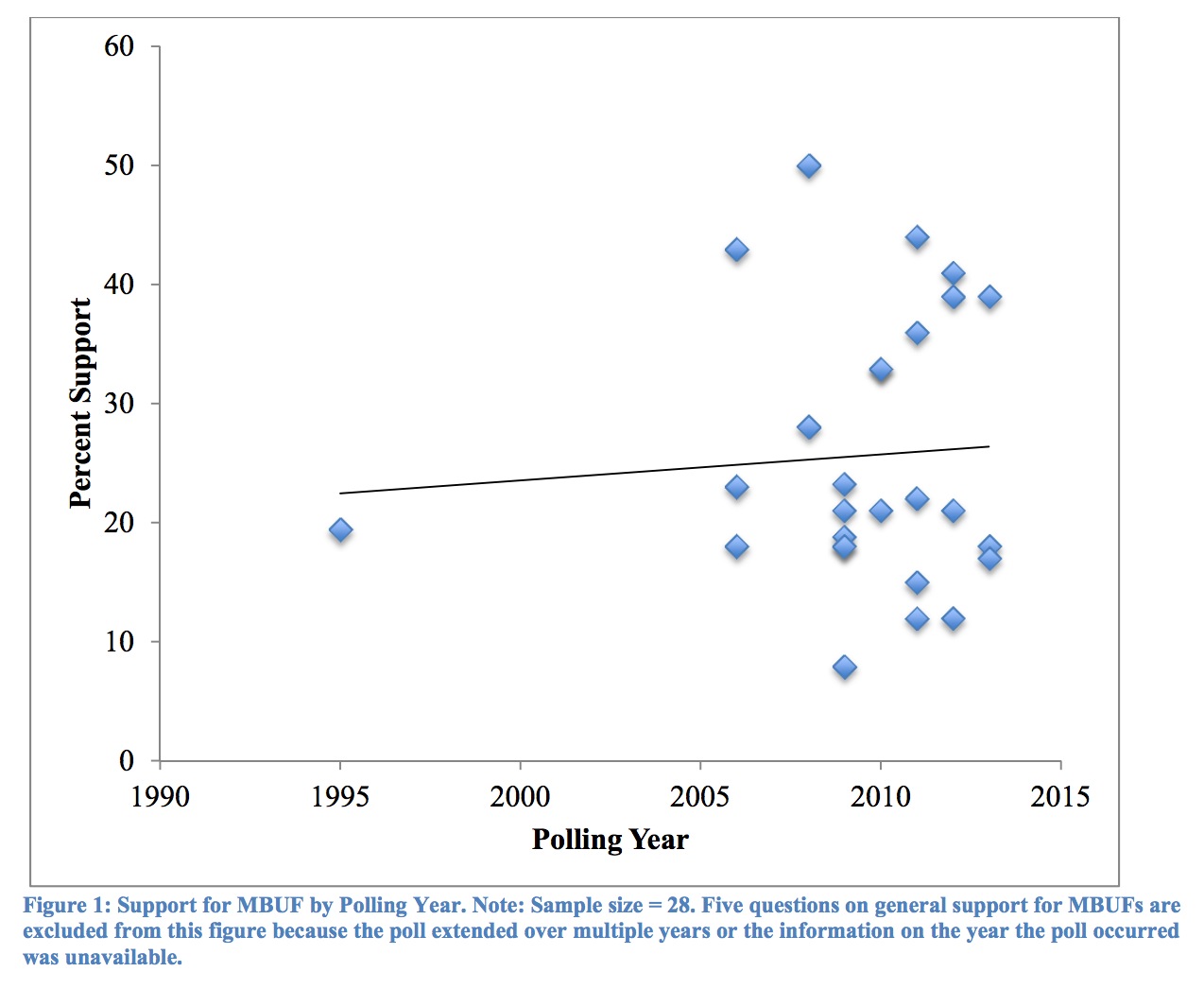

Indexing fuel taxes to inflation in addition to imposing a states’ sales tax increases revenue significantly but suffers from a continuous decline in the long-run due to increased fuel efficiency. Our results indicate that although a mileage fee is politically and technologically difficult to achieve, it avoids a declining tax revenue in the long-run.

View this complete post...

RSS Feed

RSS Feed