THE HERITAGE FOUNDATION

Given tight federal budget restraints and shrinking transportation trust fund revenues, states and the federal government need to find alternative financial resources to finance needed transportation infrastructure projects, especially maintaining and expanding the capacity of the Interstate Highway System. Increased use of public–private partnership contracts (P3s) promises to help finance some of the needed infrastructure projects, but the federal government needs to allow states more freedom to use P3s, and states need to adopt the policies and practices needed to use P3s effectively.

Archive for the ‘Private Investment’ Category

Can Public–Private Partnerships Fill the Transportation Funding Gap?

Tuesday, January 17th, 2012Risks and Rewards of Public-Private Partnerships for Highways

Friday, January 6th, 2012REASON FOUNDATION

Public-Private Partnerships (PPPs) for infrastructure are contracts between public and private entities for the provision of facilities in areas such as power, water, transportation, education and health. Well-written PPP agreements specify the allocation of risk, which should create incentives for the private provider to deliver more efficiently and in a timelier manner than would be the case if the project were undertaken by a state-controlled entity.

The Case for Business Investment in Public Transportation

Thursday, December 22nd, 2011

AMERICAN PUBLIC TRANSPORTATION ASSOCIATION

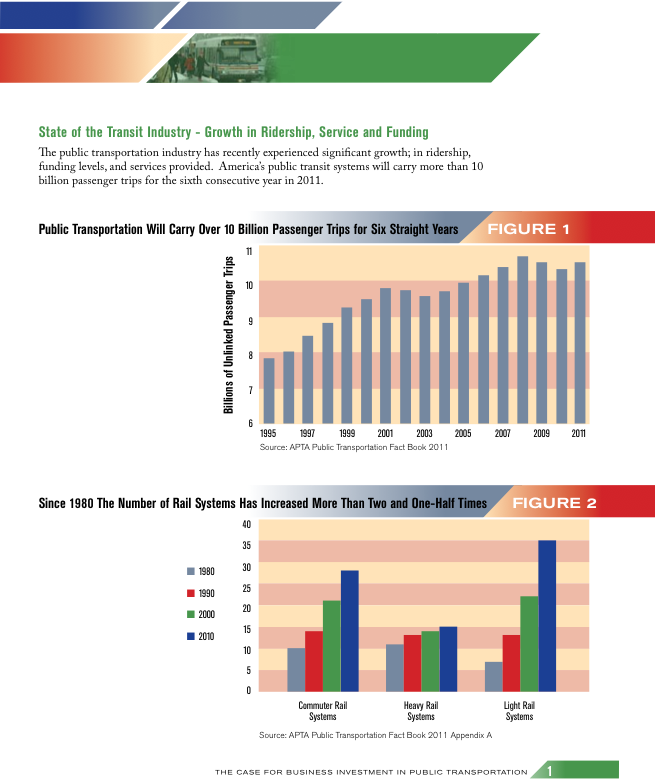

Public transportation is an enterprise with expenditure of $55 billion in the United States. There has been a steady growth trend over the past three decades, with long-term economic and social trends (population, energy, public choice) all pointing to an even more prominent future standing. Since 1980, the number of fixed-guideway systems has grown exponentially with a bevy of projects positioned to systems has grown exponentially with a bevy of projects positioned to become the next generation of investment. Investment from all levels of government is on a long-term upward trend, and public support for more and better public transportation, as measured through ridership and public approval of transit ballot measures (a 73 % approval rate over the past 12 years) continues to increase.

View this complete post...Benchmarking Electric Utility Energy in the U.S.

Friday, November 18th, 2011

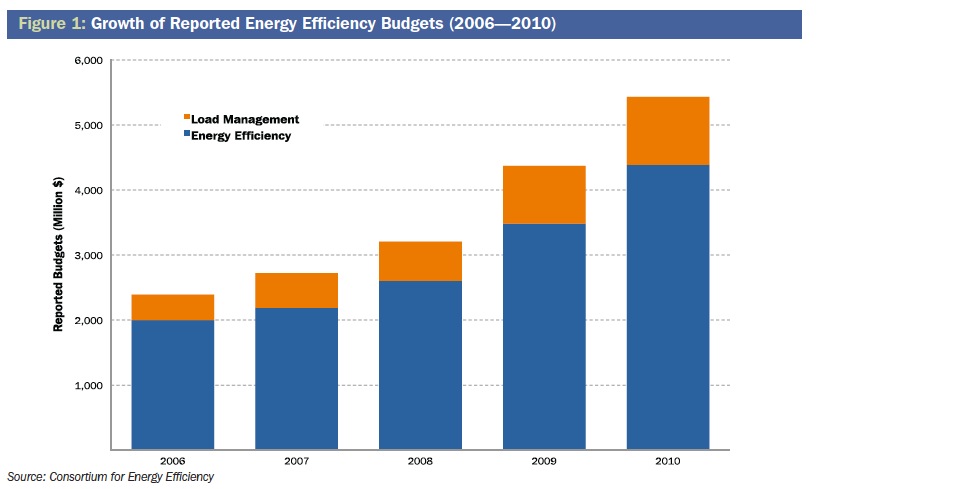

CERES

In these uncertain economic times, making smart investments in energy is of paramount importance. Our country faces a critical need for jobs, energy security, and cleaner ways to power our economy. Investing in energy efficiency has the potential to help address each of these challenges…Utilities are at the center of the energy efficiency opportunity. They manage millions of customer relationships, hold data on energy use patterns across their service territories, and have the ability to assist utility commissions by displacing generation with sound energy efficiency policies.

Talking Infrastructure with Engineers at ASCE’s 141st Annual Civil Engineering Conference

Friday, November 11th, 2011This is the first in a series of posts.

Steven CF Anderson, Managing Director of InfrastructureUSA speaks with several engineers attending the American Society of Civil Engineers 141st Annual Civil Engineering Conference held last month in Memphis, Tennessee:

The Ceres Aqua Gauge: A FRAMEWORK FOR 21ST CENTURY WATER RISK MANAGEMENT

Thursday, October 20th, 2011

CERES

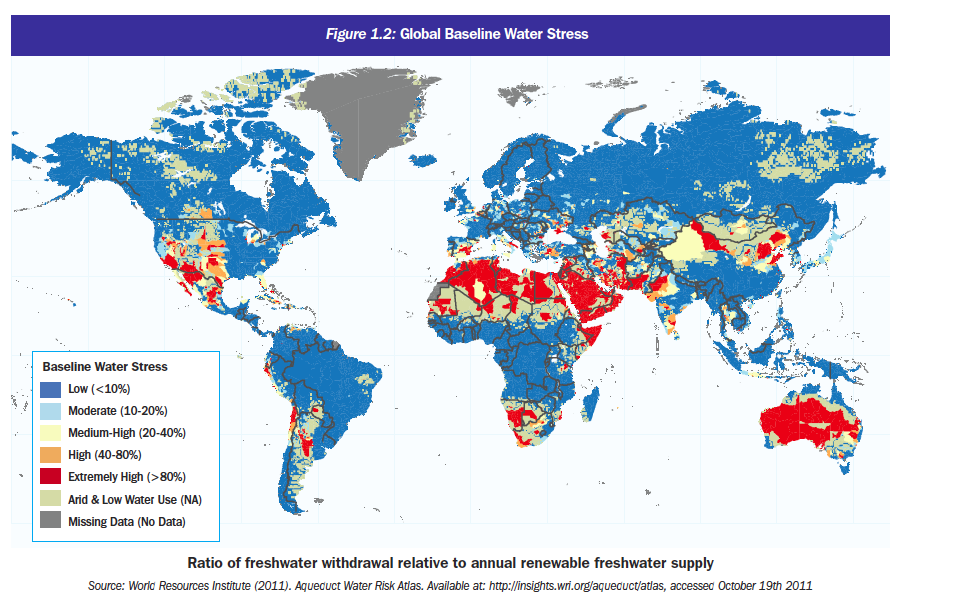

Increasing water demand by the power and energy sectors is another growing competitive pressure. Many forms of electric power require massive amounts of water for cooling, with the sector accounting for 41 percent of total water withdrawals in the United States and 44 percent in the European Union. The water intensity of fuel production is also on the rise. In 2009, only five percent of the world’s liquid fuels came from water-intensive “unconventional” sources such as biofuels, oil sands and shale oil. By 2035, the U.S. Energy Information Administration predicts, that number could double or even triple, depending on global oil prices.

December 7th-8th: Infrastructure Investor: Americas 2011

Friday, September 16th, 2011

From PEI: Investors in infrastructure are looking for more sophisticated investments, many exploring a direct platform, co-investments or secondary positions. Entering into these large scale investments can be intimidating, particularly in the Americas where the opportunities are great but the deal flow is sluggish. In response to this, Infrastructure Investor: Americas returns to New York […]

View this complete post...The Benefits of Private Investment in Infrastructure

Wednesday, September 14th, 2011

SPHERE CONSULTING

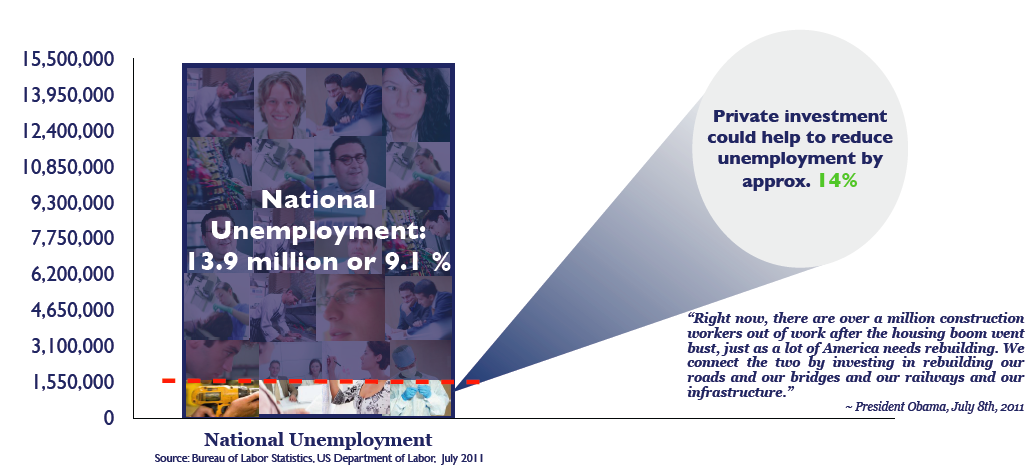

-Jointly public and private investment in infrastructure can create millions of jobs. The private sector is already largely responsible for designing, building, and financing our nation’s infrastructure and can do more.

-Over $250 bn of private capital has been raised, and some additional legislative and administrative changes could accelerate infrastructure projects and enhance funding.

-Private investment in infrastructure frees government dollars for allocation to other troubled areas of the economy and transfers risk away from the public partner to the private entity.

What’s Next for U.S. Cities?

Thursday, August 25th, 2011THE CENTER FOR AN URBAN FUTURE

On April 25, 2011, the Center for an Urban Future and the Rockefeller Foundation convened a small, private roundtable discussion with more than a dozen of the nation’s thought leaders to discuss the key trends, opportunities and challenges that U.S. cities face over the next two decades—with a particular focus on the critical issues expected to impact the most vulnerable urban residents. The purpose of the conversation was to help the Rockefeller Foundation, and the larger philanthropic community, identify the key megatrends, challenges and opportunities that will affect those living in U.S. cities over the next 20 years.

View this complete post...Follow InfrastructureUSA

CATEGORIES

- Accountability (219)

- Aging Infrastructure (756)

- Aviation (130)

- Biking (323)

- Bipartisan (271)

- Bridges (493)

- Broadband (57)

- Buses (160)

- Carbon Tax (22)

- Clean Air (182)

- Climate Change (200)

- Competitiveness (230)

- Congestion (327)

- Dams (77)

- Democrat (123)

- Drinking Water (191)

- Economic Stimulus (276)

- Employment (207)

- Energy (585)

- Environment (615)

- Equity (239)

- Funding (888)

- Global (205)

- Great American Infrastructure (33)

- Green (294)

- Guests on The Infra Blog (282)

- Hazardous Waste (27)

- High Speed Rail (224)

- Highway (785)

- Inland Waterways (204)

- Jobs (251)

- Land Use (98)

- LEED (28)

- Levees (42)

- Local (1,910)

- National (1,526)

- Policy (1,121)

- Pollution (215)

- Private Investment (213)

- Public Opinion (189)

- Public Parks & Recreation (197)

- Public Transportation (1,028)

- Racism (6)

- Rail (503)

- Recession (65)

- Recovery (218)

- Republican (109)

- Roads (1,120)

- Schools (80)

- Seaports (68)

- Smart Grid (98)

- Smart Growth (442)

- Solid Waste (26)

- Sustainability (765)

- Tax (112)

- Technology (397)

- Telecommunications (46)

- Transit (1,333)

- Urban Planning (981)

- Wastewater (181)

- Water Treatment (166)

Video, stills and tales. Share images of the Infra in your community that demands attention. Post your ideas about national Infra issues. Go ahead. Show Us Your Infra! Upload and instantly share your message.

Is the administration moving fast enough on Infra issues? Are Americans prepared to pay more taxes for repairs? Should job creation be the guiding determination? Vote now!

What do the experts think? This is where the nation's public policy organizations, trade associations and think tanks weigh in with analysis on Infra issues. Tell them what you think. Ask questions. Share a different view.

The Infra Blog offers cutting edge perspective on a broad spectrum of Infra topics. Frequent updates and provocative posts highlight hot button topics -- essential ingredients of a national Infra dialogue.

Dear Friends,

It is encouraging to finally see clear signs of federal action to support a comprehensive US infrastructure investment plan.

Now more than ever, our advocacy is needed to keep stakeholders informed and connected, and to hold politicians to their promises to finally fix our nation’s ailing infrastructure.

We have already engaged nearly 280,000 users, and hoping to add many more as interest continues to grow.

We require your support in order to rise to this occasion, to make the most of this opportunity. Please consider making a tax-deductible donation to InfrastructureUSA.org.

Steve Anderson

Managing Director

SteveAnderson@InfrastructureUSA.org

917-940-7125

RSS Feed

RSS Feed