NATIONAL ASSOCIATION OF MANUFACTURERS

Executive Summary

Modern economic growth and development depends on high-quality infrastructure. There is no getting around it. However,

what, exactly, does that involve? Infrastructure spans a wide range of public and private assets, including highways and bridges,

airports, ports and inland waterways, electricity plants and transmission lines, information and telecommunication networks and

water and sewage facilities. Such assets are indispensable for facilitating production across various industries—not least of

which include agriculture, energy, mining and, in particular, manufacturing. The ability to safely and efficiently move goods from

a manufacturing facility to a customer located far away is crucial to the industry’s long-term health and global competitiveness.

In other capital-intensive industries, such as telecommunications and electricity distribution, infrastructure plays an equally

important role. Beyond the manufacturing industry, basic infrastructure also underlies the daily occupational and recreational

activities of U.S. households. Our energy, mobility, information and travel capabilities all depend on safe, accessible and reliable

infrastructure.

Unfortunately, recent data concerning U.S. public- and private-sector spending indicates a decline in real investment spending

for many types of infrastructure. Real or “constant-price” investment is the purchase of structures and equipment by government

entities and private companies, where dollar amounts have been adjusted for inflation. It, therefore, is an indication of the

physical volume of infrastructure installed in each year. The decline goes beyond the recent recession and includes a period

that stretches over the past decade. Consumers are cognizant of delays and congestion problems along urban corridors and

airport runways. Others experience breakdowns in water supply and sewage because much of the nation’s drinking water and

wastewater infrastructure is rapidly aging. Even private infrastructure is not immune from underinvestment. However, most

notably and noticeably deficient is the state of the nation’s streets and highways. Costs in time, wasted fuel and vehicle

maintenance continue to grow annually. According to the Texas A&M Transportation Institute’s 2012 Annual Urban Mobility

Report, the cost of congestion has escalated to $121 billion, or $818 per commuter. Trucks moving freight along the nation’s

roads and highways bear a significant cost of that congestion—$27 billion is derived from wasted time and diesel fuel.

Quantifiable evidence exists to support public concern over the current state of U.S. infrastructure. Every four years, the

American Society of Civil Engineers (ASCE) conducts a national assessment of conditions and investment needs for major types

of infrastructure, including roads, bridges, water systems, ports, mass transit and the electricity grid. According to the ASCE,

the nation’s infrastructure is failing. Few of the systems garner even a “C” grade, and the overall grade in 2013 was a “D+,” up

from a “D” in 2009.

This report provides a historical accounting of infrastructure investment and offers a “whole picture” assessment that is important

to the well-being and growth of the manufacturing economy. The report provides new evidence on the state of private-sector

infrastructure and offers additional data concerning the deteriorating state of U.S. public infrastructure. Findings include the

following:

- Recent trends in private sector infrastructure investment reflect a mixed performance. Freight rail and electric utilities have experienced steady and strong investment over the past decade. On the other end, capital investment in the communications and private water supply and wastewater industries would have been more robust if it were not for a protracted recession, a slow recovery and uncertainties in the regulatory environment. The burgeoning pipeline industry requires new investments and the regulatory certainty that would come from successful approval and construction of the Keystone XL pipeline.

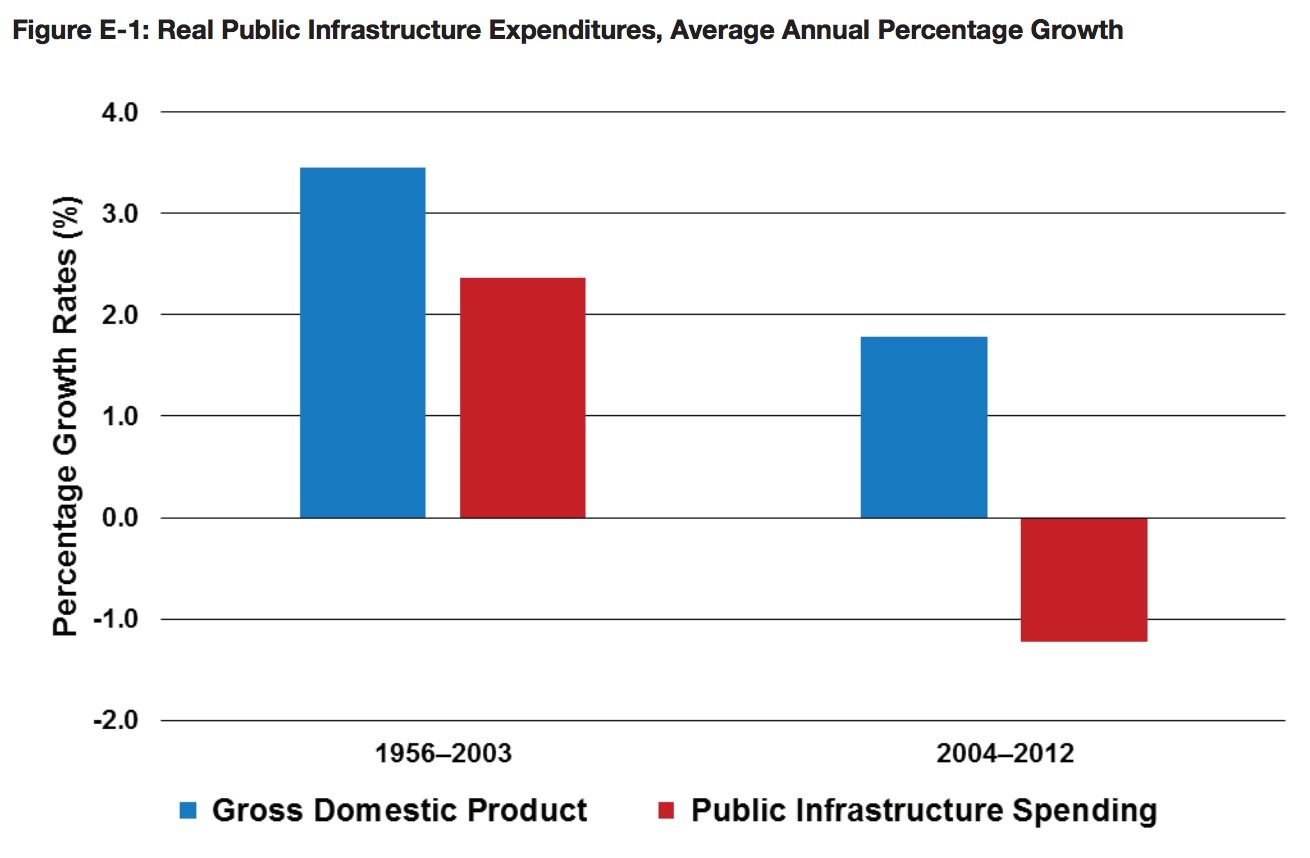

- The average annual growth of real GDP and real public infrastructure spending over two intervals—1956-2003 and 2004- 2012—is shown in Figure E-1. In the almost 50 years through 2003, infrastructure investment rose, albeit at an average rate of about 1 percent lower than GDP growth. Over the past nine years, GDP has grown more slowly on average. Perhaps not coincidently, real infrastructure spending has contracted sharply by more than 1 percent per year during this period, and this investment expenditure has lagged GDP growth by a whopping three percentage points on average.

- Early in the decade, a sharp escalation of construction prices eroded effective investment because each dollar of federal and state funding purchased relatively less infrastructure capital. Then, as the recession took hold in December 2007, public spending contracted in nominal terms, especially at the state and local level. Although construction inflation fell from previous highs and the federal government provided an infrastructure stimulus through the American Recovery and Reinvestment Act, the volume of investment spending continued to decrease. In total, the volume of public infrastructure investment was 10.5 percent lower in 2012 compared to 2003, and available data indicate it has fallen further since then.

- Expenditure details for the major categories of public infrastructure are shown in Table E-1, reflecting real spending levels from 2003- 2012. Five types of expenditures concern transportation: highways and roads, mass transit, rail, aviation and ports and inland waterways. The remaining two types concern water infrastructure: water resources and water supply and waste disposal. In contrast to most of the preceding 45 years, the volume of investment in almost all of the public infrastructure categories contracted significantly from 2003 through 2012— disturbingly so for highways and roads. The level of real investment in highways and roads was almost 20 percent lower in 2012 compared to 2003.

- A resulting effect is the inability to gain ground in improving the nation’s infrastructure base. Therefore, it is not just a matter of restoring growth to infrastructure budgets to reverse the decade-long decline. Current approaches to funding, financing, building and maintaining infrastructure do not create the opportunity to catch up on a backlog of deferred projects that states and localities have been unable to complete. Patterns noted in this report provide further economic evidence consistent with the engineering analysis of the ASCE as well as the competitiveness analysis of the World Economic Forum,4 the global manufacturing competitiveness analysis of Deloitte and the U.S. Council on Competitiveness5 and a survey of U.S. manufacturing executives released in 2013.6

- To make up for the almost decade-long decline in infrastructure capital spending, a more focused and results-driven effort that expands and sustains higher levels of investment from all public and private infrastructure sources would have positive short- and long-term economic returns. In the short run, investment in infrastructure stimulates aggregate demand that increases economic activity and creates jobs through direct, indirect and induced demand impacts. However, the longterm benefits of infrastructure spending are even more significant and durable. Improvement of roads, highways and bridges, for instance, would boost industrial competitiveness in proportion to the industry’s use of trucking services and other ground transport infrastructure. Manufacturers that depend heavily on trucking for receiving supplies and delivering products would benefit the most from this boost to competitiveness. In turn, cost savings would be passed on to customers, both at home and abroad.

- This study leverages available historical data and previous work concerning the economic costs of degraded infrastructure as it considers how an increase in public infrastructure investments would affect economic performance. The Inforum analysis uses the LIFT model of the U.S. economy to show how infrastructure investments above current funding levels will help to recover nearly a decade of underinvestment in infrastructure, enable higher growth, improve trade performance, expand employment opportunities and enhance the real value of household incomes.

Download full version (PDF): Catching Up

About the National Association of Manufacturers

www.nam.org

The National Association of Manufacturers (NAM) is the largest manufacturing association in the United States, representing small and large manufacturers in every industrial sector and in all 50 states. Manufacturing employs nearly 12 million men and women, contributes more than $1.8 trillion to the U.S. economy annually, has the largest economic impact of any major sector and accounts for two-thirds of private-sector research and development. The NAM is the powerful voice of the manufacturing community and the leading advocate for a policy agenda that helps manufacturers compete in the global economy and create jobs across the United States.

RSS Feed

RSS Feed