OFFICE OF THE STATE TREASURER OF CALIFORNIA

JOHN CHIANG, TREASURER

A Long-Term Approach to a Long-Term Liability

California is an economic behemoth. It generates $2.3 trillion in goods and services annually and employs nearly 11 percent of the nation’s civilian workforce. By almost any measure, the Golden State is home to the United States’ most powerful and diverse state economy.

Yet, ironically, we are burdened by one of the lowest municipal bond credit ratings of all 50 states. Three principal ratings agencies give lower marks to only two other states, New Jersey and Illinois. In addition to our revenue volatility, rating agencies point to a lack of an adequate mid-year process for fine-tuning our budget proposal and a perceived need for better management of our long-term liabilities. I have been diligent in focusing on these liabilities, including California’s $74 billion in unfunded retiree health care benefits. I proposed, and strongly support, a plan to pre-pay those benefits. This is part of a financial solution to a long-term problem.

But, there is an even larger long-term liability facing Californians: the cost of repairing and replacing our fast-deteriorating roads, bridges, seaports, government buildings and other publicly owned assets. This critical infrastructure supports our place in a global economy—and that benefits all Californians. Dealing with this challenge requires a new mindset to long-term planning and a new approach to decision making.

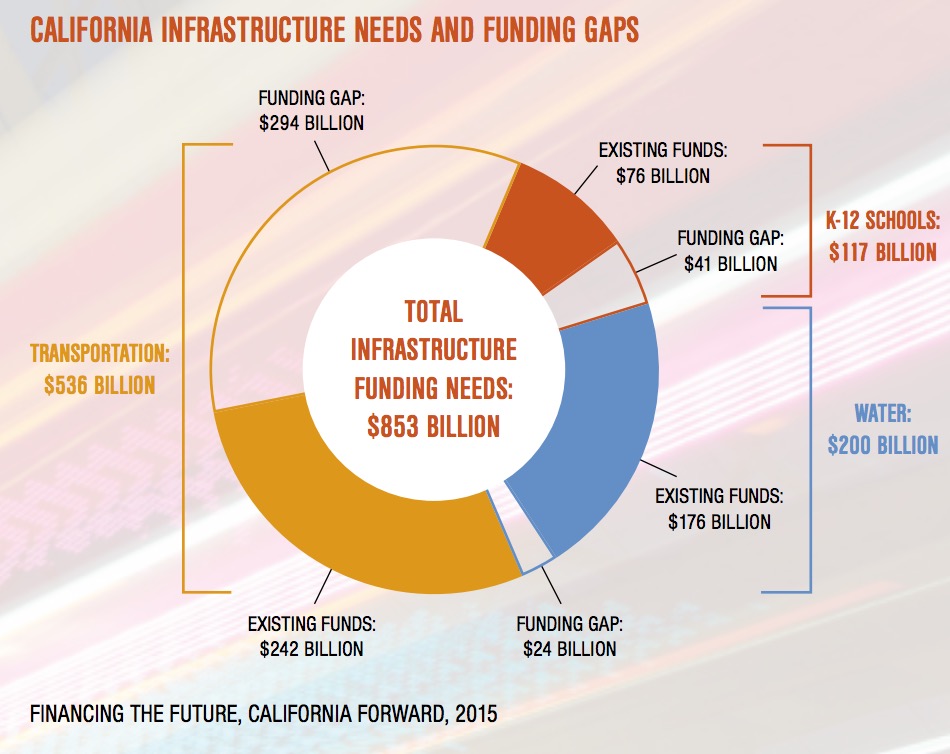

In 2015, California Forward, a private sector think-tank focusing on California’s future, estimated that the state needs to invest $853 billion in water, transportation and K-12 schools infrastructure improvements over the next ten years. Further, they estimate that California’s resources over the coming decade will fall far short and leave us a $358 billion funding gap. The American Society of Civil Engineers in 2012 found that 34 percent of California’s roads are in poor condition, and more than 2,700 bridges are structurally deficient.

Infrastructure, said the National League of Cities, is one of the top three problems that most constrain municipal budgets. The League estimated a $3 trillion backlog nationwide. Failure to fix this problem could be costly, if not catastrophic, for all levels of government and could threaten our economy’s ability to create jobs, investment capital and quality of life.

As treasurer, and previously as controller, I have seen state and local governments struggle under the financial burdens of long-term liabilities because they were unwilling or unable to come up with strategic plans that are sustainable. In recent years, the state has made some progress in dealing with unfunded retiree health care and now it is time to do the same with our infrastructure deficiencies.

The Legislature took up the infrastructure issue in a 2015 special session on transportation. While it considered several thoughtful plans, no concrete action has been taken.

I congratulate the governor on making a down payment on this issue by proposing to use as much as $1.5 billion of “one-time” revenues to attack our deferred maintenance. My proposal builds on that step and is intended to encourage the state’s leaders to talk about about what bold steps we need to take to rebuild our state. Let us begin by conducting an annual and comprehensive assessment of state infrastructure needs, launching an infrastructure finance center of excellence and creating a reserve fund to pay for new and rehabilitated facilities.

About California State Treasurer John Chiang

www.treasurer.ca.gov

John Chiang was elected on Nov. 4, 2014, as California’s 33rd State Treasurer. As the State’s banker, he oversees trillions of dollars in transactions every year. One of his top priorities is to conduct the State’s business in the most transparent manner possible.

Tags: CA, California, John Chiang, Office of the State Treasurer of California

RSS Feed

RSS Feed