ROCKY MOUNTAIN INSTITUTE

EXECUTIVE SUMMARY

Over the past decade, distributed solar photovoltaics (DPV) have experienced unprecedented growth. DPV is now on track to achieve significant scale in many segments of the U.S. market. Yet, nationally, solar produces 0.2% of electricity generation, leaving much room for further growth. Distributed solar’s continued growth can and should play an integral role in building the affordable, resilient, low-carbon electric grid of the future. For example, the U.S. Department of Energy’s SunShot Initiative is targeting 14% of electricity generation from solar by 2030 and 27% by 2050.

Over the past decade, distributed solar photovoltaics (DPV) have experienced unprecedented growth. DPV is now on track to achieve significant scale in many segments of the U.S. market. Yet, nationally, solar produces 0.2% of electricity generation, leaving much room for further growth. Distributed solar’s continued growth can and should play an integral role in building the affordable, resilient, low-carbon electric grid of the future. For example, the U.S. Department of Energy’s SunShot Initiative is targeting 14% of electricity generation from solar by 2030 and 27% by 2050.

Supportive federal, state, and local policies have to date spurred DPV’s development in many U.S. markets. However, many of these policies were designed for early market support of an emerging technology, not as long-term solutions. Thus as the DPV market has grown, so too has conflict around early-market policies. In many states, regulators and policy makers are now reexamining the policy environment as solar adoption reaches net energy metering (NEM) market caps or incentive program funding is exhausted. Further, at the federal level, the business investment tax credit is set to decline from 30% to 10% at the end of 2016, and the residential investment tax credit for homeowners is set to expire. The confluence of these pressures could pose a significant barrier to DPV’s market growth.

The need has become clear for additional strategies that support DPV’s continued growth into the future in line with SunShot targets. Solar policy frameworks to date have typically focused on customer-centric DPV value accruing primarily to the individual customer and/or third-party solar companies who install DPV systems. Meanwhile, under existing business models, utilities have negatively associated DPV with transaction costs, grid operation challenges, and revenue loss.

Creating a sustainable long-term DPV market will require aligning the interests of utilities, solar companies, technology providers, and customers. Aligning those interests means enhancing legacy solar business models or building new ones by creating an expanded value pool—one that makes DPV affordable and accessible to far more customers, bridges beyond individual customer-centric DPV value to include value delivered to the grid and society, and allows the electricity grid’s myriad stakeholders to share in that value.

This needed shift in the DPV market is in many ways similar to a nascent shift currently under way with thermostats. For decades, thermostats’ value proposition was customer-centric focused on the building occupant only, and manufacturers responded with business models and products that met that need. The more recent advent of smart, connected thermostats and the new opportunities they create has greatly expanded the potential value pool across the utility meter, such as by enabling customers to shift the timing of their load relative to system peak. But as with DPV today, new solutions, including new business models, require broad stakeholder alignment to deploy and then share value among customers, utilities, technology providers, and other participants.

If done well—necessarily bringing both solar companies and utilities together around the table—new solar business models can successfully accelerate, optimize, and sustain DPV adoption.

Aligning the interests of these stakeholders will involve two major threads:

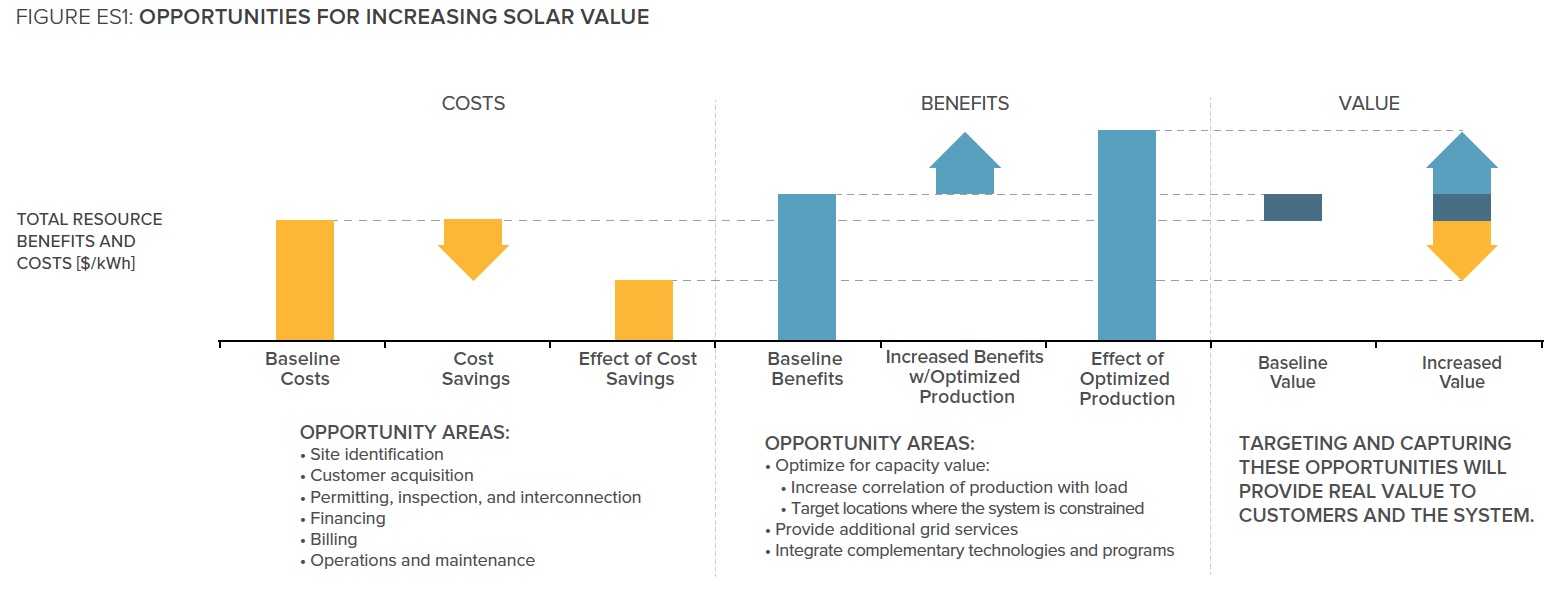

• Maximize the delivered value of DPV to customers and the electricity system by further decreasing costs and increasing benefits (see Figure ES1), and

• Create new business models that enable and incent solar companies, utilities, and customers to optimize and capture that expanded pool of DPV value through win-win-win opportunities.

To date, reducing solar’s upfront capital cost to achieve low-cost deployment onto the grid—without accounting for the operational benefits and costs of integration into the grid—has been a significant solar market development strategy. Further cost reductions are possible, especially related to DPV’s soft costs, but the most significant of them will require involvement from both solar companies and utilities together to achieve. Similarly, currently untapped operational benefits that occur post-interconnection can create additional value streams for customers, solar companies, and utilities that evolve from maximizing value for individual customers with DPV to optimizing value more broadly across such customers and the system as a whole. However, defining, valuing, verifying, and capturing those value streams will require cooperation among stakeholders.

Download full version (PDF): Bridges to New Solar Business Models

About the Rocky Mountain Institute

www.rmi.org

Rocky Mountain Institute (RMI) is an independent, non-partisan nonprofit that drives the efficient and restorative use of resources. Co-founded in 1982 by Amory Lovins, its Chairman Emeritus and Chief Scientist, RMI now has approximately 80 full-time staff, annual operations of $16 million, and a global reach and reputation.

Tags: DPV, Rocky Mountain Institute, Solar

RSS Feed

RSS Feed