MANHATTAN INSTITUTE FOR POLICY RESEARCH

Written by Aaron M. Renn, Senior Fellow

Executive Summary

America’s infrastructure discussions are dominated by debates about federal funding. But large portions of America’s roads and streets are under the jurisdiction of local governments. These locally owned roads are mostly ineligible for federal funding. So any increased federal funding of highways would have only a limited effect on the condition of local streets.

Unlike the federal and state governments, which draw heavily on dedicated road-user fees such as gas taxes, local governments rely far more on general funding for streets. In an era of fiscal constraint, this has left many local governments, urban and rural, struggling to address street- and bridge-maintenance backlogs.

Because of the limited federal role in local roads, state and local governments need to develop policies to respond to the infrastructure investment gap. These could include a “fix it first” policy of not building new or expanded roads; requiring new housing developments to retain responsibility for interior street maintenance; and increasing state gas taxes, with enhanced revenue sharing with local governments. Regardless of the policy chosen, it will ultimately require state and local, not federal, action to significantly improve the condition of America’s local roads and streets.

Introduction

The fate of the federal Highway Trust Fund (HTF) dominates America’s infrastructure debate. The HTF is the main federal-financing vehicle for both highways and transit, and it contains the proceeds from the federal tax on gasoline (18.4 cents per gallon) and diesel fuel (24.4 cents per gallon). Federal transportation spending has exceeded gas-tax revenues for several years, with the result that the HTF has been kept solvent only by a series of transfers—$62 billion since 2008—from the general fund. The Congressional Budget Office projects that if nothing is changed, a further $168 billion in deficits will be accumulated by the HTF through 2025.

This has produced a flurry of rhetoric about the danger to America’s infrastructure, which is often portrayed as troubled. For example, the American Society of Civil Engineers gives U.S. roads a letter grade of D. CBS’s 60 Minutes ran a segment on infrastructure called “Falling Apart.” The federal gasoline tax has not been raised since 1993, and many on both the left and the right see raising the gas tax as an easy way to address the HTF shortfall, including the Washington Post’s Wonkblog (“Now would be a good time to raise it”), the U.S. Chamber of Commerce (“the simplest, most straight-forward, and most effective way to generate enough revenue”), and the New York Times’s editorial board (“a small price to pay for better roads, bridges and transit systems”).

This has produced a flurry of rhetoric about the danger to America’s infrastructure, which is often portrayed as troubled. For example, the American Society of Civil Engineers gives U.S. roads a letter grade of D. CBS’s 60 Minutes ran a segment on infrastructure called “Falling Apart.” The federal gasoline tax has not been raised since 1993, and many on both the left and the right see raising the gas tax as an easy way to address the HTF shortfall, including the Washington Post’s Wonkblog (“Now would be a good time to raise it”), the U.S. Chamber of Commerce (“the simplest, most straight-forward, and most effective way to generate enough revenue”), and the New York Times’s editorial board (“a small price to pay for better roads, bridges and transit systems”).

What such arguments miss is that the HTF accounts for only about a quarter of America’s total government-transportation spending. Additionally, a significant portion of America’s infrastructure challenge is in local roads and streets, which are largely not addressable by the HTF. Many local governments have struggled to maintain their crumbling highways and streets, especially in an era of fiscal constraint. Because these roadways are predominantly paid for by local taxes and are largely ineligible for federal funding, raising the federal gas tax or other strategies to put the HTF on a solid financial footing will not make a major dent in this problem. State and local governments must act on their own to address it.

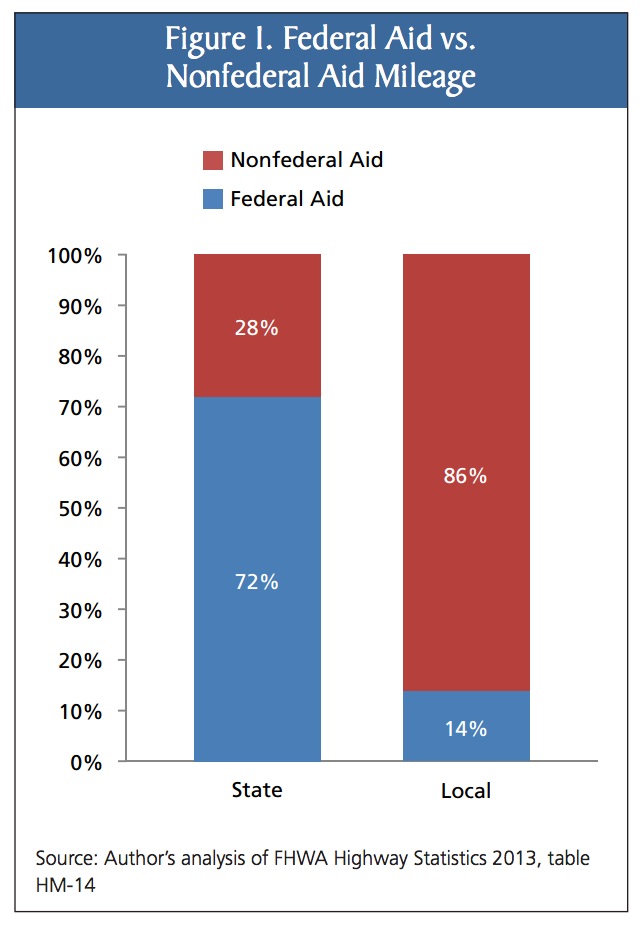

While states own a large portion of highly traveled roads, such as interstate highways, local governments are responsible for the majority of roadway mileage. Counties and municipalities, including minor civil divisions such as townships, are responsible for 3.1 million miles of roads and streets. Only 430,000 miles (14 percent) of these are part of the federal aid system. The remaining 2.7 million (86 percent) are nonfederal aid. By contrast, 72 percent of the 780,000 miles of state-owned roads are in the federal aid system (Figure 1).

Download full version (PDF): Beyond Repair?

About the Manhattan Institute for Policy Research

www.manhattan-institute.org

For over 30 years, the Manhattan Institute has been an important force in shaping American political culture and developing ideas that foster economic choice and individual responsibility. We have supported and publicized research on our era’s most challenging public policy issues: taxes, health care, energy, the legal system, policing, crime, homeland security, urban life, education, race, culture, and many others.

Tags: Aaron M. Renn, Gas tax, Highway Trust Fund, Manhattan Institute of Policy Research, MI

RSS Feed

RSS Feed