AMERICAN ROAD & TRANSPORTATION BUILDERS ASSOCIATION

OVERVIEW

Some political speculators have suggested that an increase in the federal gasoline tax to meet the nation’s staggering highway and mass transit capital investment needs as part of SAFETEA‐LU reauthorization is “politically undoable.” Their theory is that those who would advocate or support such an increase would do so at great political risk. A survey of state legislative actions on the motor fuel excise since 1997 conducted by the American Road & Transportation Builders Association’s Economics Department demonstrates that facts do not support these claims.

ACTION IN 15 STATES

Since 1997, 15 state legislatures—Arkansas, Indiana, Kansas (2), Maine (2), Michigan, Minnesota, North Dakota, Ohio, Pennsylvania, Rhode Island, South Dakota (2), Utah, Vermont, Washington and Wyoming—voted to raise their state gas tax for transportation investment purposes a total 18 times. The legislature in West Virginia voted to extend the current gas tax for six more years, and the Massachusetts General Court froze the state gas tax rate at 21 cents per gallon. The gas tax rate increases ranged from 1 cent per gallon (North Dakota) to 6 cents per gallon (Ohio). The average of all of the state highway user fee hikes was 4 cents per gallon. Connecticut lowered their gas tax by 7 cents from 32 to 25 cents a gallon, effective July 1, 2000.

The Maine legislature not only raised and indexed their annual motor fuels excise to the annual Consumer Price Index (CPI), it also increased the state’s car registration fee to raise additional revenue for transportation investment. One state increase was phased in over 3 years (Utah) and one was put in place for only 17 months, then increased again two years later (South Dakota).

THE POLITICAL MIX: STRONG BIPARTISAN SUPPORT

Successful state gas tax increase votes occurred in 11 states with Republican governors, three with a Democratic governor, and one with an Independent governor. After signing these increases, the Governors of Michigan, Pennsylvania, South Dakota, Utah, Vermont and Wyoming sought another term, and all six were re‐elected (Governor Dean of Vermont was re‐elected twice).

While most of the votes to enact highway user fee increases were solidly bipartisan, success of such measures in Republican‐controlled states is noteworthy. In 7 of the states that approved highway user fee hikes—Kansas, North Dakota, Ohio, Pennsylvania, South Dakota, Utah and Wyoming—Republicans controlled not only the governor’s seat, but also both houses of the state legislature.

Although there were several close votes in several state legislatures on this issue, on average, a state motor fuel excise increase was approved by a 74 percent voting majority.

HIGHWAY USER FEE INDEXING

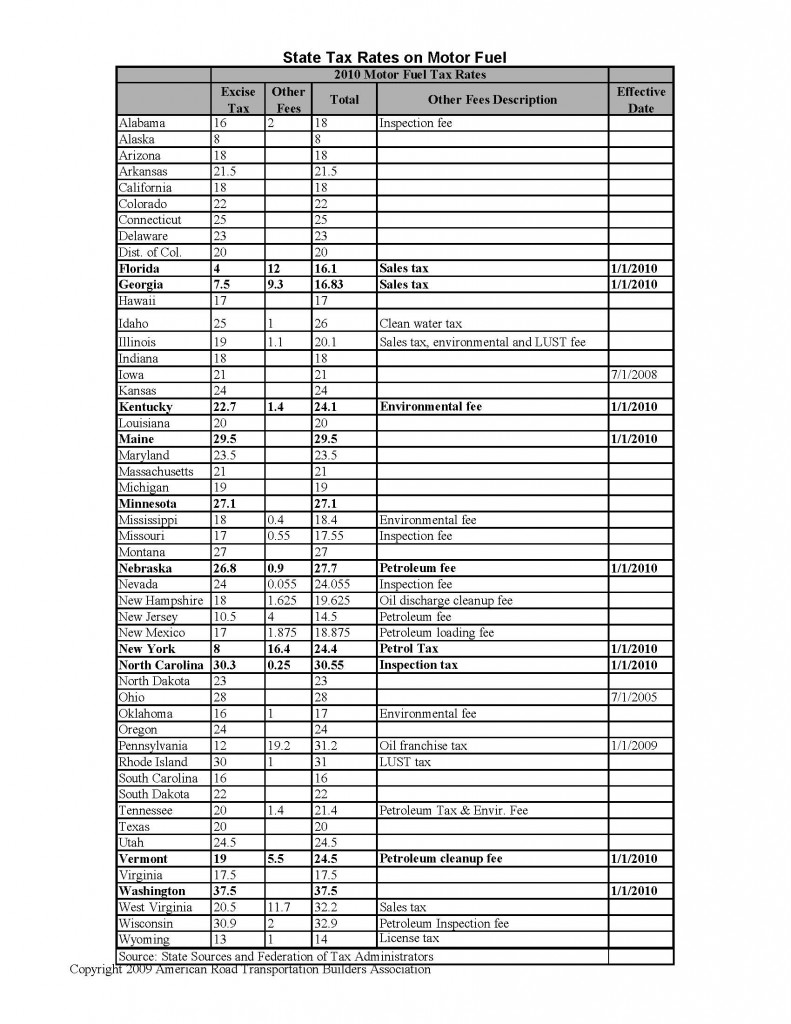

It should also be noted that over the time frame studied, the motor fuels excise also increased annually in five states—Florida, Nebraska, New York, North Carolina and Wisconsin—without legislative action. These states have a variable rate gas tax. This means that the tax rate is adjusted at a specified interval on the basis of an index or formula. (See Appendix 1) In Florida and New York there are laws that automatically index the excise tax to some measure of annual inflation to help maintain the design and construction purchasing power of their state highway user fee.

There are seven states that currently have a variable rate gas tax. 1 The legislature in each state passes enabling legislation, but does not need to approve each subsequent change in the variable rate. Maine was the most recent state to adopt a variable gas tax rate, based on inflation, which came into effect in 2003.

Download full report (PDF): STATE GAS TAX REPORT

About American Road & Transportation Builders Association

www.artba.org

“We are a federation whose primary goal is to aggressively grow and protect transportation infrastructure investment to meet the public and business demand for safe and efficient travel. In support of this mission, ARTBA also provides programs and services designed to give its 5,000+ public and private sector members a global competitive edge.”

Tags: American Road & Transportation Builders Association, ARTBA, Gas tax, SAFETEA-LU

RSS Feed

RSS Feed