AMERICAN ROAD & TRANSPORTATION BUILDERS ASSOCIATION

TRANSPORTATION INVESTMENT ADVOCACY CENTER

Executive Summary

As the use of alternative-fuel and electric cars and trucks continues to grow as a share of the U.S. fleet, state governments are relying on a mixture of user fees and taxes to ensure these drivers are contributing their fair share to highway and bridge construction and maintenance programs.

The number of alternative-fuel cars and light trucks is expected to grow from 21.5 million vehicles in 2016—accounting for 9 percent of the U.S. vehicle stock—to 29.3 million vehicles in 2021, or about 12 percent of the entire fleet, according to data from the U.S. Energy Information Administration. Alternative-fuel vehicles include electric cars and trucks, hybrids, and vehicles that run on propane, fuel cells and natural gas.

One key challenge for state governments is that these vehicles still cause wear and tear on roads and bridges, but are not paying as much in motor fuel related taxes because they use significantly less gas and diesel fuel. Alternative-fuel cars average anywhere from 50 miles per gallon for an electric-gasoline hybrid to as much as 132 miles per gallon for an electric vehicle. This is compared to an average of 26 miles per gallon for the entire stock of U.S. cars.

This report provides information on some of the strategies states are using to address the issue of alternative-fuel vehicles. Its main findings:

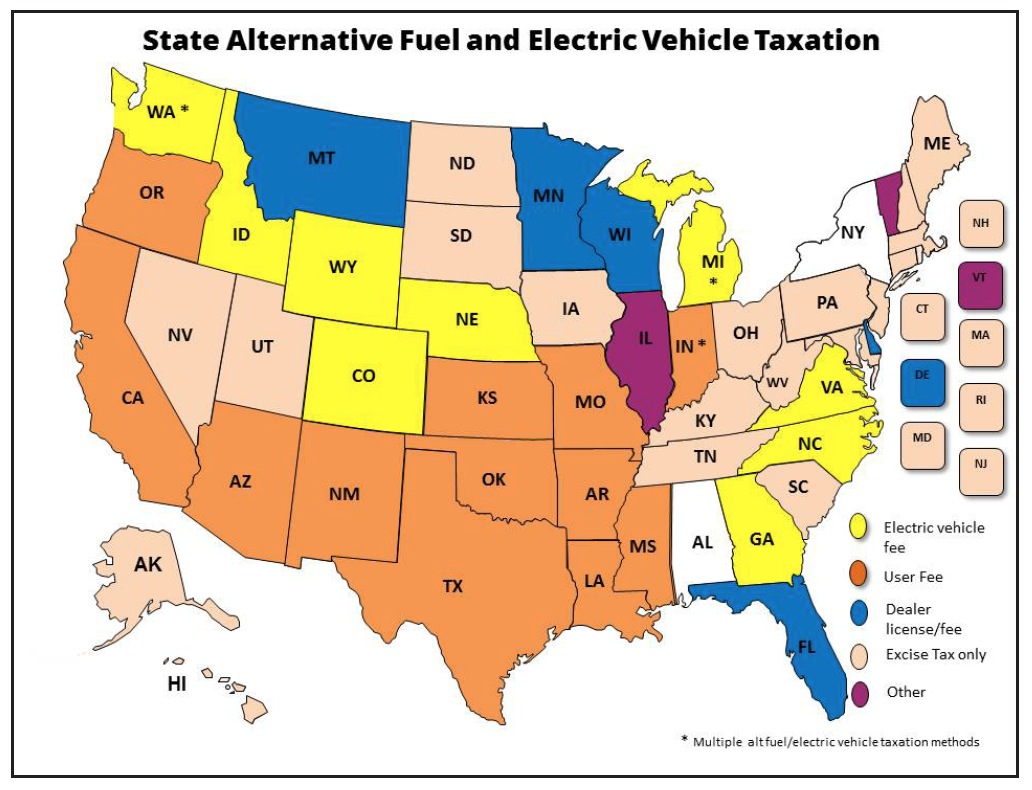

- 45 states levy a cents per gallon excise tax on the purchase of alternative fuels;

- 10 states require electric vehicle owners to pay a fee;

- 13 states provide the option for alternative fuel vehicle owners to pay a fee rather than an excise tax;

- 6 states require alternative fuel dealers to obtain a special fuel license or pay a fee; and

- 2 states apply only the state general sales and use tax to alternative fuels.

Several different alternative fuels can be used to propel a motor vehicle. Some of the alternative fuels discussed in this report include:

Liquefied petroleum gas (LPG, also known as propane): A byproduct of natural gas and crude oil production, compressed in a tank in order to become liquid. On a vehicle, LPG is stored in a tank pressurized to approximately 150 pounds per square inch. Compared to gasoline, LPG has a higher octane rating (preventing engine kickback) and increases engine service life, but has a lower British Thermal units (Btu) energy rating (requiring more fuel to drive the same distance).

Compressed natural gas (CNG): Natural gas compressed to less than 1 percent of its volume in standard atmospheric pressure. CNG is sold (and taxed, when the state chooses an excise tax) on its gasoline-gallon-equivalent (GGE), which is a measurement based on the energy content of a gallon of gasoline. One GGE equals 5.66 pounds of CNG.

Liquefied natural gas (LNG): The liquid form of natural gas after it is purified and cooled to -260 degrees Fahrenheit. While expensive, LNG is particularly suited for long-distance driving due to its density and greater amount of energy by volume. LNG is also sold (and taxed, when the state chooses an excise tax) on its gasoline-gallon-equivalent (GGE).

Biodiesel: Can be produced domestically for diesel engines from items such as vegetable oil, animal fat or recycled grease. In liquid form, pure biodiesel is referred to as B100. Blended biodiesel forms are referred to as B20 (20% biodiesel, 80% petroleum diesel), B5 (5% biodiesel, 95% petroleum diesel) and B2 (2% biodiesel, 98% petroleum diesel).

Ethanol: Created from plant mass called “biomass”, typically consisting of corn as well as other plant materials. Ethanol is most often sold as ‘E85’, a high-level blend having between 51 percent to 83 percent ethanol (subject to season and geography).

Hydrogen: An energy source for zero-emission fuel cell vehicles, such as electric vehicles, or internal combustion engines.

There are many different ways states tax alternative fuels in order to generate revenue. The most common method is to charge a per-gallon excise tax on the use of alternative fuels.

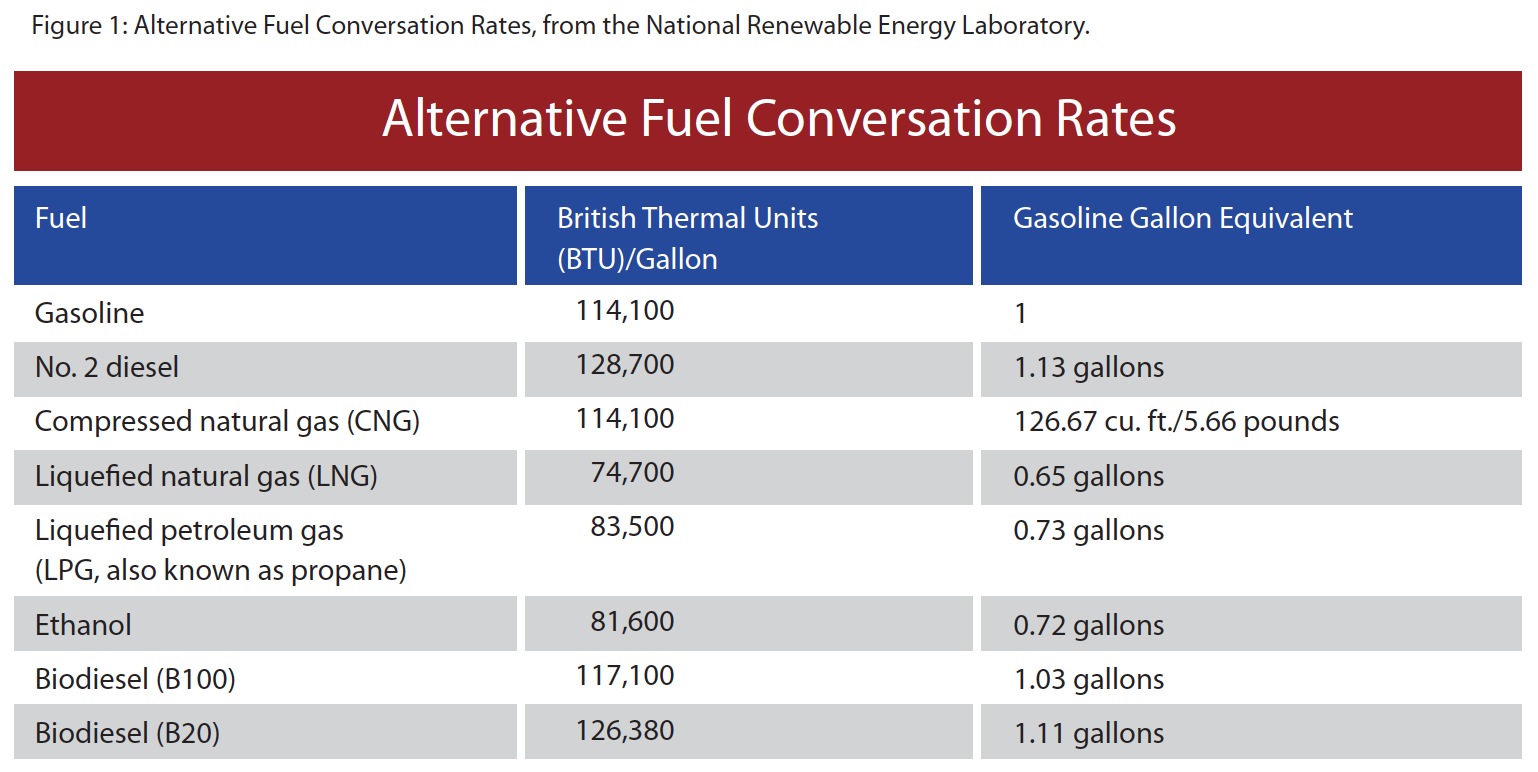

To charge per gallon of alternative fuel used or sold, several fuels—including compressed natural gas (CNG)and liquid natural gas (LNG)—are often converted into the gasoline-gallon-equivalent or diesel-gallon-equivalent (also referred to as a motor fuel gallon equivalent, or MFGE). A gallon equivalent is determined by comparing the energy content (BTus) of the alternative fuel to gasoline/diesel. The chart below from the National Renewable Energy Laboratory illustrates alternative fuel conversion rates:

Some states provide the option for owners of alternative fuel vehicles to pay an annual fee in lieu of an excise tax. This fee can include a decal, permit or license, and is generally administered at the time of vehicle registration or inspection. Several states have a flat fee, while others utilize a varied fee based on vehicle-miles traveled or vehicle weight. A fee may also be imposed on dealers of alternative fuels. Alternatively, some states require owners to pay both an annual fee and an excise tax.

Electric and hybrid vehicle taxes also vary widely in amount, as well as how they are administered. At the time of publication, eight states required personal electric vehicle or hybrid owners to pay an annual road use fee.

In addition to the fees and excise tax mentioned above, there are several alternative methods states use to tax alternative vehicles. Several apply the state’s general sales and use tax to alternative fuel purchases. Innovative programs are also attracting a lot of interest. Oregon, for example, in 2015 launched a test program to tax volunteer drivers by the amount of vehicle miles traveled, as opposed to how much fuel they consume.

About the American Road & Transportation Builders Association (ARTBA)

www.artba.org

The Washington, D.C.-based American Road & Transportation Builders Association is: America’s largest and most respected national transportation construction trade group; an aggressive and non-partisan advocate that exclusively and successfully works to build and protect the U.S. transportation construction market; the industry’s primary environmental, legal and regulatory advocate; the pre-eminent information source on transportation investment, policy, safety, economics and other key industry business issues; the leading provider of education and training programs designed to meet the unique professional development needs of transportation design, construction and safety executives; a facilitator of networking and business development opportunities nationally and internationally through events, webinars, live and virtual conferences, and committee and council meetings.

About the Transportation Investment Advocacy Center (TIAC)

www.transportationinvestment.org

The Transportation Investment Advocacy Center is a project of the American Road and Transportation Builders Association’s “Transportation Makes America Work!” (TMAW) program and funded through voluntary contributions and sponsorships. To become a sponsor or to make a contribution, visit the ARTBA store or contact TIAC staff directly through this website.

Tags: American Road & Transportation Builders Association, ARTBA, Electric Vehicles, EVs, TIAC, Transportation Investment Advocacy Center

RSS Feed

RSS Feed