AMERICAN COUNCIL ON RENEWABLE ENERGY

EXECUTIVE SUMMARY

This report on United States renewable energy finance policy is the result of extensive research, outreach, and analysis conducted over the last three years. It identifies federal and state government policies that could promote efficient private sector capital formation and investment in the renewable energy industry.

State and federal policies have worked: renewable investment has grown rapidly:

State and federal policies have worked: renewable investment has grown rapidly:

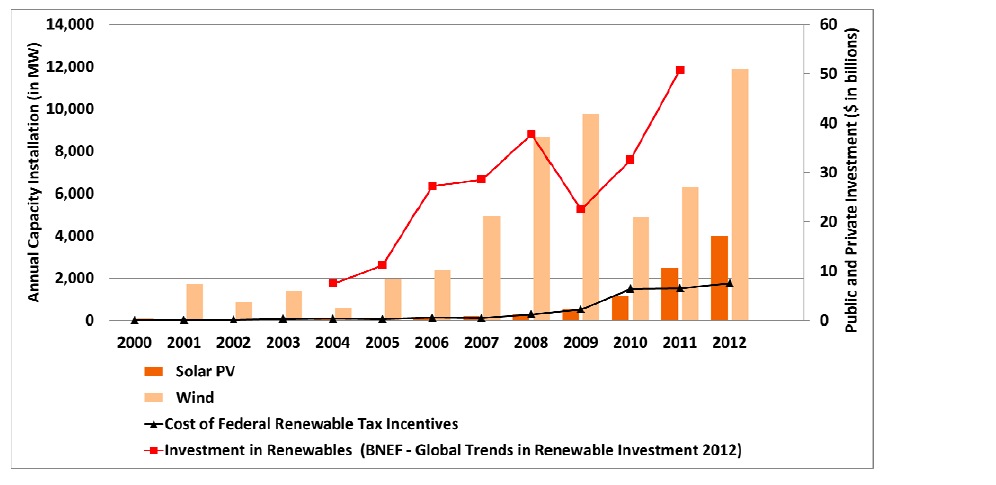

Private sector investment in the U.S. renewable energy sector has grown significantly in recent years due in large part to manufacturing and technology cost reductions, state market demand policies, and federal tax policies. The combination of these factors has contributed to impressive growth for the renewable energy industry, and this scale in turn has further reduced technology costs. Over the past five years, more than 35% of all new power generation has come from renewable energy resources, including more than 49% of all new power generation in 2012 – surpassing all other energy sources, including natural gas. Since 2004, more than $300 billion has been invested in the U.S. clean energy market (PREF), including $35.6 billion in 2012, with a corresponding significant increase in jobs. Renewable energy generation also enhances energy security by harnessing clean domestic resources to produce more of the energy we consume here in the United States.

This success was enabled by the alignment of federal, state, and private efforts:

The success of policies to date reflects the application of two important American concepts core to the progress of our nation: the role of Federalism to align our national and state governments behind a common objective, and the importance of public-private partnerships to leverage public and private resources. At the state-level, renewable energy portfolio standards (RPS) and policies like electricity market design have established the conditions through which renewable energy technologies have grown in recent years. The production and investment tax credits (PTC and ITC) have been the main federal policies complementing these important market structures.

Further scale up requires cost-effective policies that can drive low-cost private investment:

To further scale up the industry and to maintain a leadership role in the global clean energy economy, substantially greater levels of lower-cost capital investment will be needed. Our analysis suggests several principles to guide the formulation of a strategy to achieve this goal, based on these important recommendations:

Build on the success of current policy efforts

The first step to achieving this goal is to continue to build upon the success of existing policy efforts. Reinvigorated state RPS policies and long-term extension of tax credits remain important. Additional policies, including Master Limited Partnerships (MLPs) and Real Estate Investment Trusts (REITs), successful in motivating capital formation in other sectors, should be made applicable to renewable energy investment. These policies can serve to encourage even greater levels of lower cost capital investment. This combination of complementary, yet evolving federal and state policy remains essential to the continued scale up of private low-cost capital investment in the sector.

Provide a level playing field for renewable technologies

Existing federal and state policies have also helped to level the playing field between renewable and conventional resources. However, robust policy support is still necessary to maintain market momentum. A myriad of federal and state fiscal, regulatory and other policies serve to support conventional energy development. Some forms of renewable energy are cost competitive with traditional sources of energy generation now and will be even more so within the next few years. Other renewable energy and emerging technologies, crucial to the clean energy transition, will require support for a longer period of time. During this transitional period when further scale-up is pivotal to the reduction of costs, it is crucial that policy continue to enable this growth. To be clear, this level of policy support is nothing that has not previously been provided to the energy technologies of the past or is currently provided to incumbent, non-renewable energy industries.

Improve the effectiveness and cost-effectiveness of policies to drive low-cost investment

The challenge, in an era of fiscal constraint at all levels of government, is for the renewable energy industry to design and advocate for the most effective and efficient financial incentives in order to achieve rapid scale, leveraging the most value possible. The optimal form of this private finance strategy will result in both the acceleration of capital commitments to the sector, and development of broadly-owned investment assets that provide economic opportunity to a significant portion of the American population.

Reform regulatory and market design to encourage renewable investment

In the power sector, regulatory reforms and improvements in electricity market design, such as greater use of utility rate-basing renewable energy investment and the use of value-based (vs. lowest price) procurement, can also play an important role in encouraging greater investment of private capital in renewable energy. Technology cost reduction and market attributes, such as scalability and relatively quick deployment timelines, provide important incentives for utilities to invest in and deploy renewable energy generation. Power market rules play a central role in governing electricity infrastructure investment decisions. Reforms to align them with renewable energy investment are important to encourage such investment.

Many of these policy techniques are developed and deployed at the state-level. Therefore, a key supposition in this analysis is that state-level policy design for RPS markets will be crucial for industry success.

Renewable energy generation is an increasingly important part of our nation’s energy security and economic growth. A mix of federal and state policy, coupled with electricity market reforms, is key to driving sufficient private capital formation and investment. Properly designed policies can succeed in leveraging existing and new sources of capital and investor pools. However, it is critical that decision-makers continue with the policies that are currently in place, while they explore new policies and regulations. This policy certainty will ensure continued market momentum, while serving as a bridge to a future of far more private sector investment in renewable energy.

Download full report (PDF): Strategies to Scale-Up U.S. Renewable Energy Investment

About the American Council on Renewable Energy

www.acore.org

ACORE, a 501(c)(3) non-profit membership organization, is dedicated to building a secure and prosperous America with clean, renewable energy. ACORE provides a common educational platform for a wide range of interests in the renewable energy community, focusing on technology, finance and policy. We convene thought leadership forums and create energy industry partnerships to communicate the economic, security and environmental benefits of renewable energy.

RSS Feed

RSS Feed