AMERICAN COUNCIL OF ENGINEERING COMPANIES (ACEC)

Written by Gerry Donohue, ACEC’s senior communications writer

When 2018 came to a close, the U.S. economy was in a sweet spot.

“I have a hard time imagining the economic stars aligning better than they have,” says Chris Staloch, a managing director for Chartwell Financial Advisory, Inc.

Gross domestic product (GDP) grew at an estimated 3.1 percent annual pace, unemployment rates hit record lows, inflation remained under control and most sectors of the economy participated in the boom.

The A/E/C market has been no exception. Responding to ACEC’s third-quarter “Engineering Business Index” survey in September 2018, one CEO said, “Business has never been better.”

AT THE PEAK

All good things must come to an end, however, and many analysts say the economy hit its cyclical peak in 2018. On the other hand, the consensus is that the slowdown will be relatively mild and not enough to push the economy into recession.

“Last time, in 2007, there was a collapse all across the board,” says Greg Powell, managing director at FMI Capital Advisors, Inc. “This time we expect the slowdown to be shallower and with some sectors slowing more than others.”

“Tax reform and deregulation have been incredible drivers for a lot of the growth we have seen,” says Colvin Matheson, managing director of Matheson Financial Advisors.

In its third-quarter economic forecast, Deloitte Touche estimates that the stimulus in the 2017 tax law and the 2018 budget agreement added more than 2 percentage points to GDP. The positive impact of that stimulus, however, will wane in 2019 and even reverse in 2020, weakening the economy and making it vulnerable to negative shocks.

In its third-quarter economic forecast, Deloitte Touche estimates that the stimulus in the 2017 tax law and the 2018 budget agreement added more than 2 percentage points to GDP. The positive impact of that stimulus, however, will wane in 2019 and even reverse in 2020, weakening the economy and making it vulnerable to negative shocks.

The Federal Reserve forecasts the U.S. GDP growth will dip to 2.5 percent in 2019, with the strongest growth at the beginning of the year and the economy slowing in each successive quarter. In 2020, the Federal Reserve forecasts 2 percent GDP growth and 1.8 percent in 2021.

Other forecasters are not as optimistic. For 2020, the Congressional Budget Office forecasts 1.7 percent growth, and Deloitte Touche’s baseline forecasts just 0.7 percent.

Unemployment will remain at record lows, 3.5 percent in 2019 and 2020, but much of the job growth will be in low-paying retail and food service industries. Continued low unemployment rates will likely push up wages, which could fuel inflation.

Inflation fears are the primary reason the Federal Reserve has historically raised interest rates, but after the 2007 crash, the Federal Reserve has kept rates low to stimulate moribund growth. As the economy picked up pace, the Federal Reserve began raising the federal funds rate, and in late 2018 it stood at 2.4 percent. The Federal Reserve forecasts that the rate will reach 3.4 percent in 2020.

“The Fed needs to get those rates up so it can use monetary policy to boost the economy in a slowdown,” says Powell. “If the rates are not high enough, that tool will not be effective. However, it must proceed with caution so it does not prematurely cause such a slowdown.”

Further complicating the issue, says Matheson, is that the Federal Reserve is unwinding the more than $4 trillion in bonds it acquired through its quantitative easing strategy following the 2007 recession. “They are operating in uncharted waters, attempting to do that at the same time that interest rates are rising,” he says.

One other economic unknown is the potential impact of the Trump administration’s aggressive trade policies. “Depending on what level the trade war and tariffs get taken to, it could slow us down or even push us into recession,” says Staloch.

GUARDED OPTIMISM IN ENGINEERING

Many of the factors hitting the national economy could have an exaggerated impact on the A/E/C industry in the years ahead. Rising interest rates could stifle capital investment; tariffs have already led to higher construction material costs; and the tight labor market is wreaking havoc both on construction sites and in engineering firms.

The impact of a slowing economy will be buffered as engineering firms continue to ride the wave of the recent market prosperity into 2019 and even 2020.

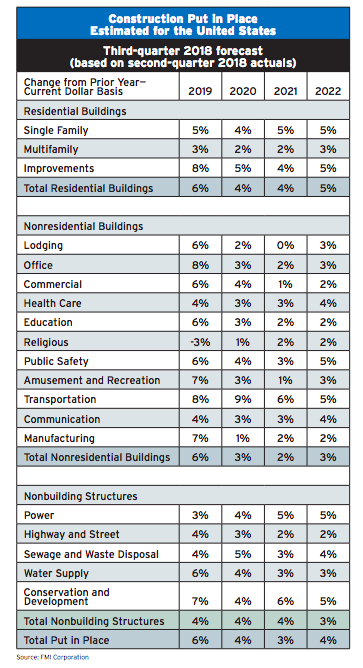

In its third-quarter 2018 forecast, leading industry analyst FMI Corporation projects the A/E/C market will grow by 6 percent in 2019, 4 percent in 2020, 3 percent in 2021 and 4 percent in 2022. FMI uses construction put in place for its forecast.

Matheson says he is “cautiously optimistic that the market will stay strong in 2019 and 2020, given firm backlogs and opportunity pipelines, with a softening likely in 2021–2022.” Meanwhile, Staloch says he is “very positive about 2019.”

“Although we are anticipating a slowdown at some point, we do not see market conditions in the U.S. changing too much in the next couple of years,” says Hisham Mahmoud, president and CEO of Golder. “All the drivers are still fairly intact.”

The most pessimistic A/E/C market forecast comes from Dodge Data & Analytics, which expects a flat 2019. Dodge, which bases its forecast on construction starts, calls for the residential market to slip by 3 percent, the nonresidential building market to be flat and the nonbuilding construction market to climb by 3 percent.

The Dodge Momentum Index, which tracks the initial report for nonresidential building projects in planning, rose through the first half of 2018 but then fell for three consecutive months, from August to October, perhaps presaging a 2019 slowdown.

SECTOR BY SECTOR

“A long-term driver in the market is the condition of U.S. infrastructure,” says Mahmoud. “Both political parties are pretty much aligned on the need to fix it although they have different approaches to funding it.”

The current long-term federal transportation infrastructure program expires in September 2020, but analysts expect Congress and the administration to address transportation infrastructure in 2019.

In its forecast, FMI projects that federal funding will remain flat. With many states having already acted to increase their funding of transportation infrastructure, FMI expects the market to struggle, growing by 4 percent in 2019 and averaging only 2.3 percent growth in 2020–2022.

In contrast, most analysts expect the deteriorating condition of the nation’s water and wastewater infrastructure system will lead to increased public investment.

“The infrastructure is aging, and we need to make sure we meet our population’s needs and safety requirements,” says Steve Lefton, president and CEO at Kimley-Horn & Associates, Inc. “In good times and bad times, you have to be able to flush your toilet.” Despite its generally dour forecast, Dodge projects 9 percent growth in the water supply market in 2019 and 5 percent growth in wastewater. FMI is not quite so bullish, forecasting 6 and 4 percent growth, respectively. Looking further into the future, FMI expects growth in the sectors to average between 3.5 and 4.0 percent in 2020–2022.

According to Mahmoud, one change that could “ignite the infrastructure sector” would be the increased use of public-private partnerships in the U.S. and an “embracing of private ownership of infrastructure.”

Download full article (PDF): While Economy Projected to Cool, Engineering Markets Still to Sizzle

Download full January/February issue of Engineering, Inc.

About the American Council of Engineering Companies

About the American Council of Engineering Companies

www.acec.org

The American Council of Engineering Companies (ACEC) is the voice of America’s engineering industry. Council members – numbering more than 5,000 firms representing more than 500,000 employees throughout the country – are engaged in a wide range of engineering works that propel the nation’s economy, and enhance and safeguard America’s quality of life. These works allow Americans to drink clean water, enjoy a healthy life, take advantage of new technologies, and travel safely and efficiently. The Council’s mission is to contribute to America’s prosperity and welfare by advancing the business interests of member firms.

Tags: ACEC, American Council of Engineering Companies, economic forecast, Engineering, Inc., Marketwatch

RSS Feed

RSS Feed