AMERICAN COUNCIL OF ENGINEERING COMPANIES (ACEC)

Written by Gerry Donohue

Battery storage is not yet ready for prime time. It is just too expensive. Although it has cost-effective applications in a few niches, such as island grids or locations where technical constraints require a non-wired solution, it doesn’t pencil out for large-scale energy storage. That dynamic, however, looks certain to change. Given the trend toward renewable energy in U.S. power generation and the rapidly improving value proposition of battery storage technology, the market is poised to grow.

Battery storage is not yet ready for prime time. It is just too expensive. Although it has cost-effective applications in a few niches, such as island grids or locations where technical constraints require a non-wired solution, it doesn’t pencil out for large-scale energy storage. That dynamic, however, looks certain to change. Given the trend toward renewable energy in U.S. power generation and the rapidly improving value proposition of battery storage technology, the market is poised to grow.

Whether that growth comes sooner or later could depend on an upcoming ruling by the Federal Energy Regulatory Commission (FERC). In November 2016, FERC issued a draft Notice of Proposed Rulemaking (NOPR) looking “to remove barriers to the participation of electric storage resources and distributed energy resource aggregations in the capacity, energy and ancillary service markets.” A final ruling is expected within a year.

With the exception of the frequency regulation market in PJM—the regional transmission operator (RTO), which oversees the mid-Atlantic states— and a few specialized applications, the majority of battery installations to date are attributed to mandates and incentive programs, according to Doug Butcher, central region project director, renewable energy, at Black & Veatch. “For significant growth to occur, widespread market reform is necessary,” Butcher says. “There needs to be some form of stimulus to push battery storage forward. If that happens, I think we’ll see rapid growth. If not, we will have to wait a few years for the economics of battery storage to work out.”

Current Market

Energy storage is a relatively small market. According to the University of Michigan Center for Sustainable Systems, the U.S. had 21.6 gigawatts (GW) of rated power in energy storage compared with 1,068 GW of total in service installed generation capacity.

Approximately 95 percent of that storage is pumped hydro, in which water is pumped from a low reservoir to a high reservoir and then released to run through a hydroelectric turbine when electricity is needed. Though it’s the most affordable form of storage, pumped hydro has two significant market limitations. It is geographically constrained—and it relies upon having large quantities of water available. This makes it impractical for bulk energy storage in some geographic regions such as deserts in the Southwest.

However, not only can batteries be deployed anywhere, but they are also very flexible. While their most effective use is demand response—regulating transmission systems by instantaneously raising or lowering output to follow moment-by-moment imbalances in generation and load—they can also be used to integrate utility-scale solar and wind resources into the transmission system, replace gas turbine peaker plants and provide stability and peaking capacity at the distribution substation and distribution feeder level.

“The grid of tomorrow is very different from the grid of just 10 years ago,” says Butcher. “With the increased penetration of renewables and declining system inertia, real-time grid imbalances are a much bigger problem today. Batteries are a great technical solution to that problem because in addition to providing instantaneous capacity when it is needed, they can absorb excess renewable generation rather than curtailing it.”

As a result, batteries—specifically lithium-ion batteries—have come to dominate the market. According to GTM Research, lithium-ion accounted for 96.2 percent of all storage installations in the third quarter of 2016.

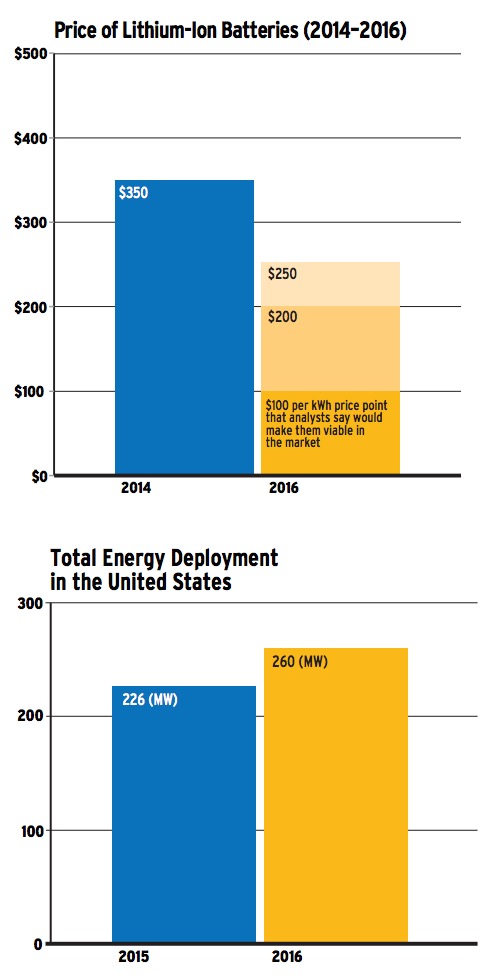

Total energy storage deployment in the United States was about 260 megawatts (MW) in 2016, up from 226 MW in 2015. GTM Research forecasts growth to accelerate over the coming five years, projecting more than 2 GW in annual deployments by 2021.

“Battery storage is a great technical answer to a number of grid issues, ranging from instantaneous imbalances and short-term overloads to time of day mismatches between renewable generation and load,” says Butcher. “The only thing that is keeping a ceiling on the market is the fundamental economics of bulk energy storage.”

Even as lithium-ion battery prices have fallen dramatically in the past two years, from around $350 per kilowatt-hour (kWh) to, according to GTM Research, $200-$250 per kWh, they are still far above the $100 per kWh price point that analysts say would make them viable in the market.

The primary driver of that price drop has been rapid growth of the electric car market, and General Motors, which produces the Volt electric car, has said that its batteries will reach $100 per kWh by 2022. Given the remarkable downward trajectory of battery prices in recent months, however, few would be surprised to see that milestone reached long before then.

Regulatory Mandates

Absent price competitiveness, the battery storage industry has relied on regulatory actions to build market momentum. Two of the nation’s transmission operators, which coordinate, control and monitor regional electrical power markets, have incorporated storage into their systems.

PJM has included storage in its capacity, energy and ancillary service markets since 2013. Since then, PJM has been the largest U.S. market for energy storage with more than 250 MW of cumulative deployments, according to GTM Research.

In 2013, California mandated that the state’s power industry must procure 1.3 GW of energy storage by 2020. The utilities, which are overseen by the California Independent System Operator (ISO) have already deployed 73.8 MW, making the state the second-largest storage market in the nation.

In the past three years, these two developments have accounted for almost all of the nation’s energy storage deployments.

Battery storage proponents hope these regional successes will be replicated on a national level if FERC embraces storage in its upcoming ruling. About 70 percent of the nation’s electrical grid system is regulated by FERC through its oversight of the RTOs and ISOs. In the rest of the country, vertically integrated utilities manage the grid.

If FERC does embrace storage, that would require each RTO and ISO to establish market rules recognizing the characteristics of energy storage resources and their place in the wholesale market, says Robert Schulte, a partner in Schulte Associates LLC, which performs resource planning and project development work for electric utilities. “It would define distributed energy resource aggregators as a market participant in the organized wholesale markets,” he says.

Schulte says the ruling would provide access to the grid for the growing number of storage batteries that are “behind the meter” on customer’s premises.

“Unlike traditional generation facilities upon which most of the current market rules are based, these distributed resources are relatively small in size, operate differently and have output duration limitations,” he says, “but their capabilities could be useful at the wholesale level if allowed to access it.”

Because it would be too complex and cost prohibitive for owners of these distribution-level devices to try to participate in the market themselves, Schulte says, “The proposed rule would also require the RTOs/ISOs to allow aggregation of such devices, enabling entities to represent groups of devices in the market.”

Future Market

Schulte says FERC’s blessing to storage “is a key to the economics of batteries,” but he and other analysts agree that the market will not explode overnight. The regional organizations will need time to incorporate storage into their systems.

I think you will see measured growth in the sector over the next two to three years,” says Peter Boos, Burns & McDonnell business development manager for the transmission and distribution industry. “After that, with improved battery prices and new regulation, I expect rapid growth.”

Even though most analysts expect lithium-ion batteries to be the dominant storage technology for the foreseeable future, they have a serious drawback.

“The Achilles’ heel of lithium-ion and most other battery chemistries is that they degrade rapidly with cycle age,” says Frank Jakob, a battery storage subject matter specialist at Black & Veatch. “A battery can lose 20 percent or more of its capacity in 3,000 cycles, so you might have to replace it in five to 10 years if the cycle rate is one to two cycles per day.”

Engineers are working to solve lithium-ion’s degradation problem, but the door is open for other technologies to gain a foothold in the market.

One promising technology is flow batteries, which contain two electrolyte solutions in two separate tanks, circulated through two independent loops. When connected to a load, the migration of electrons from the negative to the positive electrolyte solution creates a current.

Flow batteries don’t have any cycling degradation and can be easily scaled up, but they are far more expensive than lithium-ion, and they lack the market backing to drive down the price.

Other potential systems include hydrogen storage, superconducting magnetic energy and synthetic natural gas storage.

“With the amount of investment dollars that are being spent in this space, it’s only a matter of time before someone comes up with something better than lithium-ion,” says Boos.

Download full article (PDF): Battery Storage Market Poised for Growth

Download March/April issue of Engineering, Inc.

About the American Council of Engineering Companies

About the American Council of Engineering Companies

www.acec.org

The American Council of Engineering Companies (ACEC) is the voice of America’s engineering industry. Council members – numbering more than 5,000 firms representing more than 500,000 employees throughout the country – are engaged in a wide range of engineering works that propel the nation’s economy, and enhance and safeguard America’s quality of life. These works allow Americans to drink clean water, enjoy a healthy life, take advantage of new technologies, and travel safely and efficiently. The Council’s mission is to contribute to America’s prosperity and welfare by advancing the business interests of member firms.

Tags: ACEC, American Council of Engineering Companies, Batteries, Battery Storage, Engineering Inc., University of Michigan Center for Sustainable Systems

RSS Feed

RSS Feed