CERES

Executive Summary

2015 is shaping up to be a pivotal year for climate policy internationally. In December, 192 countries will convene in Paris to finalize a climate agreement intended to keep global temperature increases below two degrees Celsius.

An agreement will come at a critical time. International investment to mitigate climate change is far below levels needed to reach the two-degree target. The International Energy Agency estimates that an average of an additional $1 trillion in incremental financing for clean energy is needed to meet the temperature target1 —the “Clean Trillion.” Currently, global clean energy investment levels are about 25 percent of what is needed: $321 billion in 2014.

Institutional investors, and the corporations they invest in, are playing a growing role in financing the clean energy infrastructure needed to meet international climate goals. These investors and companies must support policymakers who seek an international agreement that will provide clearer market signals and greater certainty for needed clean energy investments.

In September 2014, over 350 investors representing $24 trillion in assets issued the Global Investor Statement on Climate Change, calling on governments to create an ambitious global agreement that includes a meaningful price on carbon. Climate change poses portfolio-wide risks to institutional investors, while the technologies and business models needed to address climate change provide significant investment opportunities. Ceres has outlined recommendations for institutional investors, the companies they invest in, and policymakers to achieve the needed new investment of $1 trillion annually in its 2014 report, Investing in the Clean Trillion: Closing the Clean Energy Investment Gap. Ceres and our U.S. and international investor network partners also recently released a guide for asset owners, Climate Change Investment Solutions, as well as a web-based platform for identifying and recording climate, clean energy and decarbonization investments and commitments.

This paper connects the Clean Trillion goal to the current United States climate and clean energy policy framework, which is a mixture of federal, state, and local initiatives. The paper outlines the 2015 U.S. policy priorities of the Policy Working Group of the Investor Network on Climate Risk (INCR), a network of more than 110 institutional investors primarily based in the U.S., focused on investment risks and opportunities associated with climate change.

Protecting and scaling policies that help to bring institutional investors’ capital into clean energy will be key to achieving the pledge made by the United States to reduce emissions by 17 percent by 2020 and by 26-28 percent by 2025. Strong and credible U.S. targets will be key, in turn, to achieving an international agreement in Paris. With clear policy frameworks in place, institutional investors are poised to play a greater role in financing clean energy.

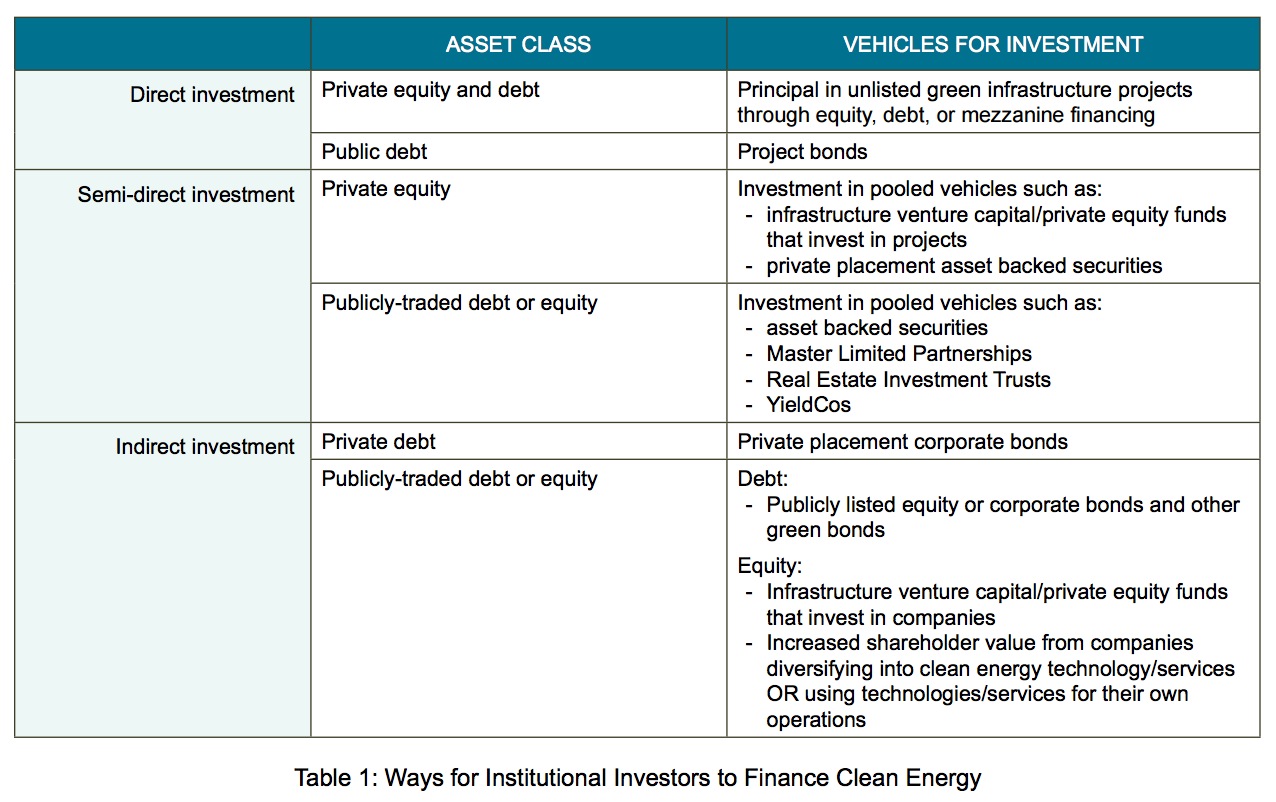

Any policy framework that hopes to bring institutional investors’ capital to financing clean energy infrastructure should consider impacts across a diversified portfolio, since institutional investors typically invest broadly across asset classes and industries. Already, investors (including pension funds, mutual funds, and insurance companies) are investing in green bonds, new instruments like YieldCos, private equity funds financing renewable energy projects, and a range of companies producing or using clean energy services and products.

Download full version (PDF): Accelerating U.S. Clean Energy Deployment

About Ceres

www.ceres.org

Ceres (pronounced “series”) is a national network of investors, environmental organizations and other public interest groups working with companies and investors to address sustainability challenges such as global climate change.

Tags: Ceres, Clean Energy

RSS Feed

RSS Feed