TRANSPORTATION INVESTMENT ADVOCACY CENTER

New Developments

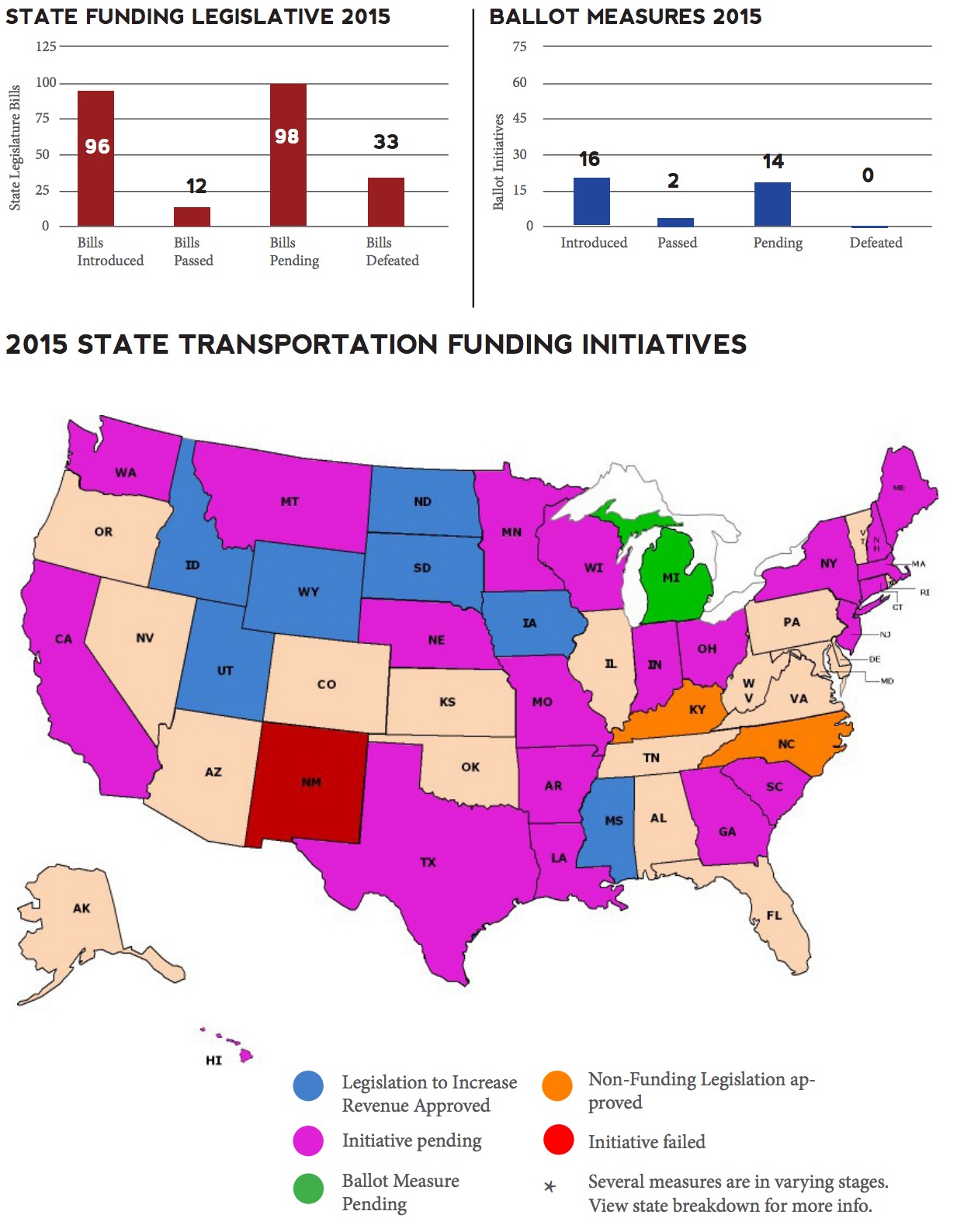

Legislation

Nine states— La., Minn., Mo., Neb., N.H., N.J., S.C., Texas, Wash.— are currently considering legislation to increase their gas tax or sales tax on gasoline.

Three states— Conn., La., and Texas— are currently considering legislation to protect their transportation funds from diversions.

Three states— Ark., Mich., and Mo.— have pending legislation to convert the flat-rate excise tax on fuel entirely to a variable-rate tax. Additionally, a bill in Maine proposes indexing the flat gas tax to the Consumer Price Index.

Seven states— Conn., Maine, Mass., Minn., N.Y., Wash., and Wisc.— have proposed bonds to pay for transportation projects.

Georgia lawmakers have sent two bills to raise an estimated $975 million in recurring revenue and bonds for the state’s transportation infrastructure to Governor Nathan Deal (R) for review.

Mississippi approved $200 million in bond financing for the state’s transportation infrastructure on March 27.

Idaho approved on April 21 two bills: HB 312– a 7 cents-per-gallon state gas tax increase, higher vehicle registration fees, and a new fee on electric and hybrid cars in order to generate almost $95 million in transportation funding; and HB 132, higher fees on gaseous special fuels for $375,000 annually.

Utah approved on March 27 a bill to increase the state gas tax by 5 cents-per-gallon, create a 12 percent tax on the statewide average wholesale price of motor fuel to replace the flat gas tax in the future (once AWP reaches $2.45/ gallon), and permit counties to seek voter approval for a 1/4-cent sales and use tax increase for local transportation projects. A fiscal note estimates the bill could generate $101,625,500 for the Transportation Fund in the first two years.

Ballot Initiatives

No ballot measures were introduced this month.

Activity Status Year-to-Date

Legislation

S.D. approved March 17 a 6 cents-per-gallon state gas tax increase, an additional 1 percent to the motor vehicle excise tax, and to raise license plate fees by 20 percent to generate over $80 million for state and county highway and bridge investment.

Iowa on Feb. 25 approved a 10 cents-per-gallon state gas tax increase, resulting in an estimated $200 million per year for transportation funding.

As part of N.D.’s “Surge Funding” bill approved in Feb., $450 million was allocated for ND DOT state highway funding, with an additional $352 million to be distributed to counties for road and bridge projects.

Minn. approved $3 million of disaster relief funds for roads and highways in areas affected by summer flooding.

Ballot Initiatives

Michigan Sales Tax Increase for Transportation Amendment (May 2015): A proposal to increase the state’s sales and use tax by 1 percent, “tie-barred” with a number of road-funding bills which would take effect if the ballot measure is approved. The package of transportation bills would result in an annual increase of $1.2 billion for highway and bridge investment and $112 million for transit and rail improvements.

Total Statewide Funding Approved Year-to-Date: $1,482,000,500

Download full version (PDF): State Funding Initiatives Report

About the Transportation Investment Advocacy Center

www.transportationinvestment.org

The Transportation Investment Advocacy Center ™ (TIAC) is a first-of-its kind, dynamic education program and internet-based information resource designed to help private citizens, legislators, organizations and businesses successfully grow transportation investment at the state and local levels through the legislative and ballot initiative processes.

Tags: American Road & Transportation Builders Association, ARTBA, Transportation Investment Advocacy Center, Transportation Makes America Work

RSS Feed

RSS Feed