BIPARTISAN POLICY CENTER

Introduction

Natural gas is one of America’s most important energy resources. Comparatively clean burning and less carbon intensive than oil or coal, it is used as a fuel in a wide variety of applications throughout the economy. Rapid technological advancements in horizontal drilling and hydraulic fracturing have unlocked a large volume of gas resources in North American shale gas formations. These developments have significant implications for the domestic supply outlook for natural gas, and for the potential to expand natural gas use in the U.S. economy.

A number of studies over the past few years have examined the impact of individual supply and demand drivers, such as natural gas use in the transportation sector, LNG exports, improvements in energy efficiency technologies, changes in the electric power sector fuel mix, and the varying size of natural gas resource base estimates, among other factors.2 All of these studies have been useful and have contributed to an improved understanding of how the shale-driven shift in the natural gas resource base will affect natural gas markets and create new market opportunities for expanded gas use.

BPC sought to build on this work by analyzing the combined effect of multiple natural gas demand drivers under a range of supply assumptions. The analysis is designed to answer key policy questions: What are the price impacts when multiple demand drivers act in concert? How will price impacts vary under high and low supply assumptions? To address these questions, BPC staff undertook an energy scenario modeling exercise examining how new unconventional natural gas supplies might affect supply and demand dynamics in the domestic energy sector. The purpose of this effort is to develop realistic scenarios that usefully bound the range of plausible outcomes for natural gas supplies and demand over the next few decades, as well as potential impacts in terms of fuel mix, energy prices, and opportunities to expand natural gas use in ways that improve the environmental performance of the U.S. energy system.

To solicit input on the analysis and seek guidance on specific supply and demand assumptions, scenarios, and results, BPC convened an advisory group of energy policy experts and stakeholders. Advisory group members provided invaluable technical assistance, information, and advice to BPC staff throughout this process.

Scenarios

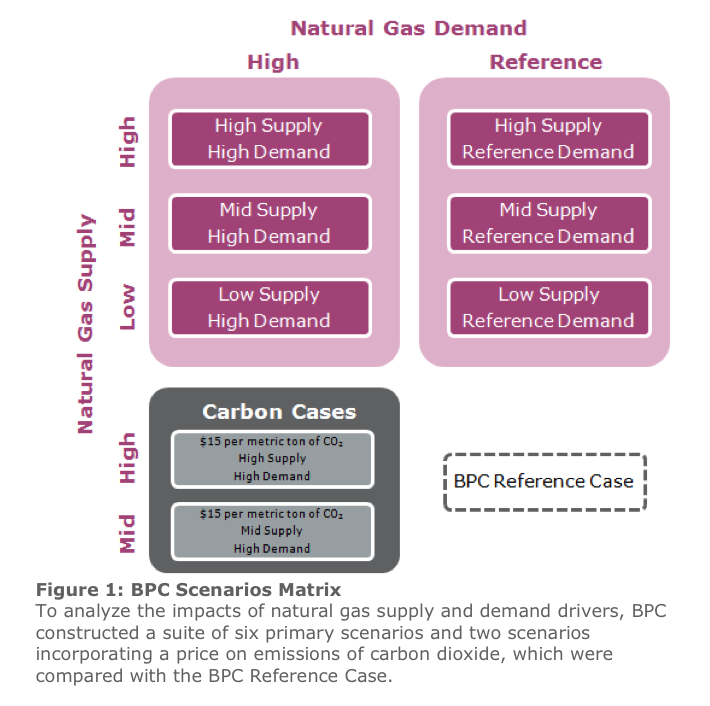

BPC constructed a suite of scenarios designed to examine various levels of natural gas supply and demand. Three supply cases—Low, Mid, and High—were combined with two demand cases—Reference and High—for a total of six scenarios (see Figure 1). In two additional scenarios, the Mid and High Supply cases were run with the High Demand case and a $15-per-metric-ton price on CO2 emissions in 2013 that escalates at a rate of 5 percent per year, in real terms, thereafter. All of these scenarios were compared with a base case (BPC Reference Case) consistent with projections developed by the U.S. Energy Information Administration (EIA) for its AEO2012.

Read full report (PDF) here: New Dynamics of the U.S. Natural Gas Market

About the Bipartisan Policy Center

bipartisanpolicy.org

“The Bipartisan Policy Center (BPC) drives principled solutions through rigorous analysis, reasoned negotiation, and respectful dialogue. Founded in 2007 by former Senate Majority Leaders Howard Baker, Tom Daschle, Bob Dole and George Mitchell, BPC combines politically-balanced policymaking with strong, proactive advocacy and outreach.”

Tags: bipartisan policy center, BPC, Coal, energy resources, New Dynamics of the U.S. Natural Gas Market, Oil

RSS Feed

RSS Feed