DEPARTMENT OF THE TREASURY

Executive Summary

President Obama’s FY 2013 Budget proposes a bold plan to renew and expand America’s infrastructure. The plan includes a $50 billion up-front investment connected to a $476 billion six-year reauthorization of the surface transportation program and the creation of a National Infrastructure Bank. In support of this commitment, the Department of the Treasury, with the Council of Economic Advisers, has updated our analysis of the economic effects of infrastructure investment. The new data and analyses confirm and strengthen our finding that now is an ideal time to increase our investment in infrastructure for the following four key reasons:

- Well-designed infrastructure investments have long-term economic benefits and create jobs in the short run;

- This economic activity and job creation is especially timely as there is currently a high level of underutilized resources that can be used to improve and expand our infrastructure;

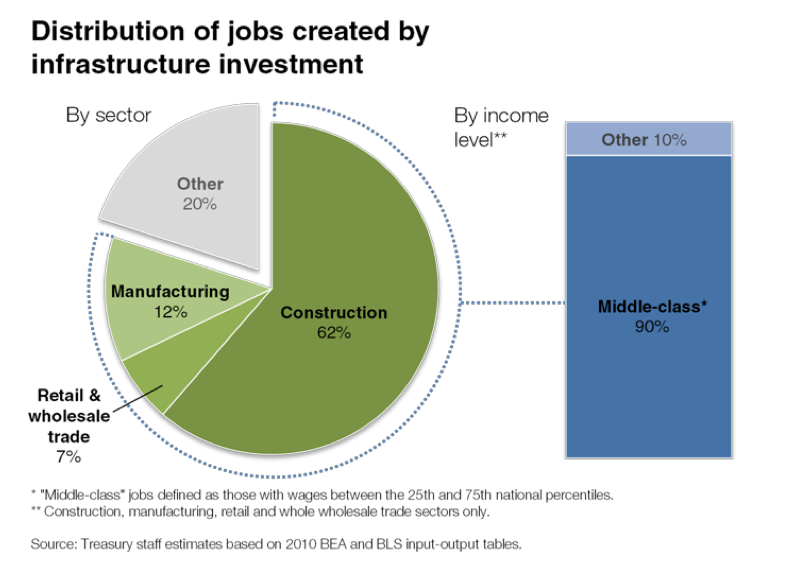

- Middle-class Americans would benefit disproportionately from this investment through both the creation of middle-class jobs and by lowering transportation costs for American households; and

- There is strong demand by the public and businesses for additional transportation infrastructure capacity.

Return on Investment

- Many studies have found evidence of large private sector productivity gains from public infrastructure investments, in many cases with higher returns than private capital investment. Research has shown that well-designed infrastructure investments can raise economic growth, productivity, and land values, while also providing significant positive spillovers to areas such as economic development, energy efficiency, public health, and manufacturing.

- However, not every infrastructure project is worth the investment. Investing wisely in infrastructure is critically important, as is facilitating private financing for public infrastructure. Traditional funding methods limit the flexibility and cost-effectiveness of infrastructure financing. For example, there is currently very little direct private investment in our nation’s highway and transit systems due to the current method of funding infrastructure, which lacks effective mechanisms to attract and repay direct private investment in these types of infrastructure projects.

- Newer funding initiatives address some of these funding shortcomings. The establishment of a National Infrastructure Bank would enable greater private sector co- investment in infrastructure projects. A National Infrastructure Bank would also allow for the rigorous analysis required to direct support to projects with both the greatest returns to society and the long-run economic benefits that can justify up-front investments.

- Build America Bonds (BABs) were another highly successful tool to attract additional private capital to finance infrastructure projects. These bonds were used to fund over $180 billion for new public infrastructure such as bridges, transit systems, and hospitals from 2009 through 2010 in all 50 states and the District of Columbia. Reinstatement of the BABs program is proposed in the President’s Budget.

Read full report (PDF) here: A NEW ECONOMIC ANALYSIS OF INFRASTRUCTURE INVESTMENT

About the U.S. Department of the Treasury

www.treasury.gov

“Mission: Maintain a strong economy and create economic and job opportunities by promoting the conditions that enable economic growth and stability at home and abroad, strengthen national security by combating threats and protecting the integrity of the financial system, and manage the U.S. Government’s finances and resources effectively.”

Tags: Barack Obama, Department of the Treasury, Infrastructure Investment, National Infrastructure Bank

RSS Feed

RSS Feed