NATIONAL RENEWABLE ENERGY LABORATORY

Executive Summary

Historically, federal incentives for renewable energy development in the United States largely consisted of the investment and production tax credits (ITC and PTC) and the accelerated depreciation benefit for renewable energy property [the Modified Accelerated Cost Recovery System (MACRS) and the bonus depreciation]. Both the ITC and the PTC provide financial incentives for development of renewable energy projects in the form of tax credits that can be used to offset taxes paid on company profits. Given that many renewable energy companies are relatively nascent and small, their tax liability is often less than the value of the tax credits received; therefore, some project developers are unable to immediately recoup the value of these tax credits directly. Typically, these developers have relied on third-party tax equity investors to monetize the value of the main federal incentives for renewable energy project development. However, in the wake of the 2008/2009 financial crisis, the pool of tax equity investors dramatically decreased, limiting the ability of renewable energy project developers to recoup the value of these tax credits. In order to minimize any stagnation in the renewable energy industry as a result of the weakened tax equity market, the United States Congress created the §1603 Treasury grant program under the American Recovery and Reinvestment Act. This program offers renewable energy project developers a one-time cash payment—in lieu of the ITC and PTC and equal in value to the ITC (30% of total eligible costs of a project for most types of energy property)—thereby reducing the need for project developers to secure tax equity partners.

Although the primary intent of the §1603 program was to minimize the impact of the weakened tax equity market on renewable project development, as part of the Recovery Act, the program also had “the near term goal of creating and retaining jobs” in the renewable energy sector. This analysis responds to a request from the Department of Energy Office of Energy Efficiency and Renewable Energy (DOE-EERE) to the National Renewable Energy Laboratory (NREL) to estimate the direct and indirect jobs and economic impacts of projects supported by the §1603 Treasury grant program. The analysis employs the Jobs and Economic Development Impacts (JEDI) models to estimate the gross jobs, earnings, and economic output supported by the construction and operation of solar photovoltaic (PV) and large wind (greater than 1 MW) projects funded by the §1603 grant program.

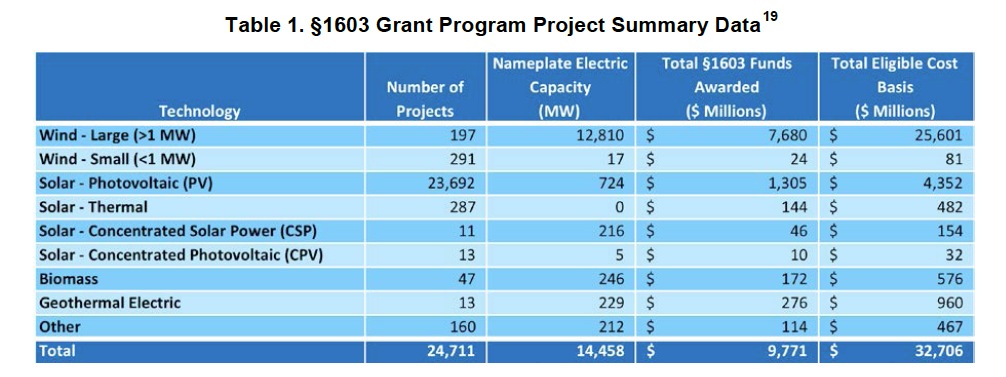

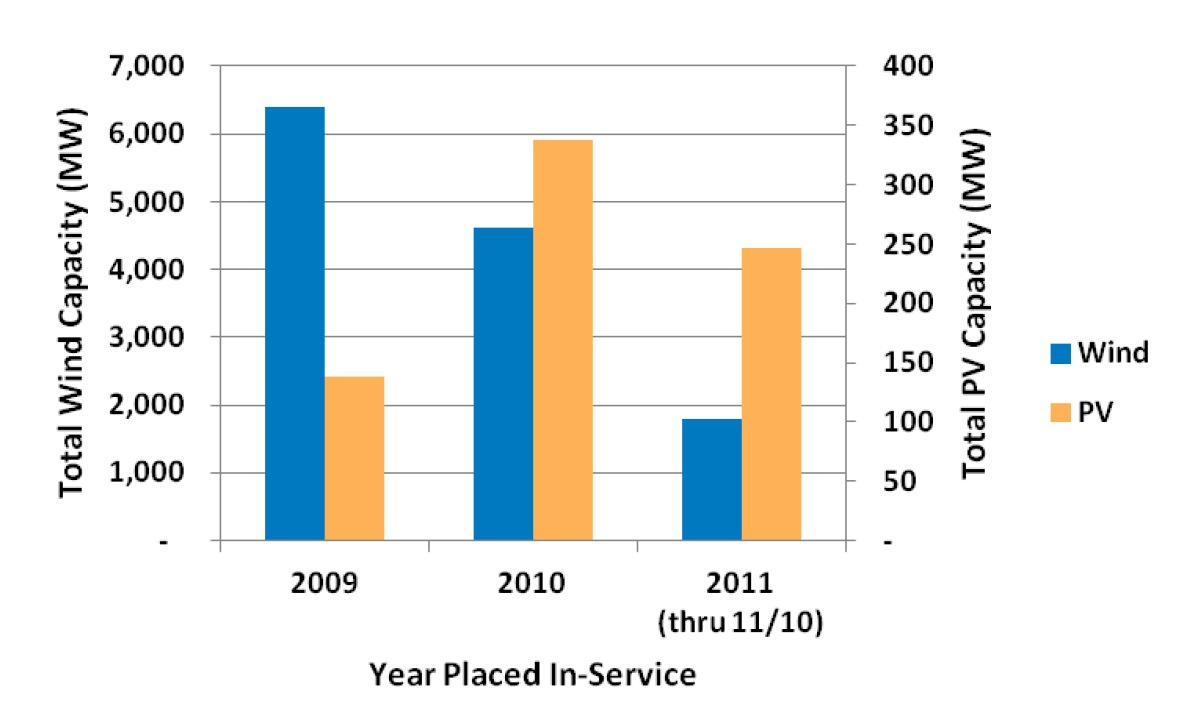

Through November 10, 2011, the §1603 grant program has provided approximately $9.0 billion in funds to over 23,000 PV and large wind projects, comprising 13.5 GW of electric generating capacity. This represents roughly 50% of total non-hydropower renewable capacity additions in 2009–2011. Total investment in these projects, which includes capital investments from all private, regional, state, and federal sources (including §1603 funds), is estimated to exceed $30 billion. These PV and large wind projects account for approximately 94% of the total generation capacity of projects funded under the §1603 program and represent 92% of total payments.

The estimated gross jobs, earnings, and economic output supported by the PV and large wind projects that received §1603 funds are summarized below and in Table ES-1:

- Construction- and installation-related expenditures are estimated to have supported an average of 52,000–75,000 direct and indirect jobs per year over the program’s operational period (2009–20115). This represents a total of 150,000– 220,000 job-years. These expenditures are also estimated to have supported $9 billion–$14 billion in total earnings and $26 billion–$44 billion in economic output over this period. This represents an average of $3.2 billion–$4.9 billion per year in total earnings and $9 billion–$15 billion per year in output.

- Indirect jobs, or jobs in the manufacturing and associated supply-chain sectors, account for a significantly larger share of the estimated jobs (43,000–66,000 jobs per year) than those directly supporting the design, development, and construction/installation of systems (9,400 per year).

- The annual operation and maintenance (O&M) of these PV and wind systems are estimated to support between 5,100 and 5,500 direct and indirect jobs per year on an ongoing basis over the 20- to 30-year estimated life of the systems. Similar to the construction phase, the number of jobs directly supporting the O&M of the systems is significantly less than the number of jobs supporting manufacturing and associated supply chains (910 and 4,200–4,600 jobs per year, respectively).

The estimated ranges reported reflect uncertainty in the domestic content of a system and its components—the portion of total project expenditures spent on U.S.-manufactured equipment and materials such as turbines, towers, modules, or inverters. Based on a review of a number of studies specifically addressing domestic content for these types of systems, and recognizing the complexity and changing nature of solar and wind supply chains, a range for domestic content was applied in the analysis. This included a low of 30% to a high of 70% for both solar and wind systems, spanning the ranges observed in the literature. The lower end of the impact estimates noted above reflects the 30% domestic content assumption while the higher end reflects the 70% assumption. While this range reflects the implications of uncertainty in one key input to the economic impact estimates, it should not be construed as fully bounding uncertainty in the ultimate estimates of the economic impacts.

About the National Renewable Energy Laboratory

www.nrel.gov

“The National Renewable Energy Laboratory (NREL) is the only national laboratory solely dedicated to advancing renewable energy and energy efficiency technologies from concept to commercial application. For 35 years, NREL innovations, analysis, and expertise have enabled the emergence of a U.S. clean energy industry and led to numerous success stories from across the laboratory. NREL’s 327-acre main campus in Golden, Colorado, is a living model of sustainable energy. The laboratory also operates the National Wind Technology Center on 305 acres located 13 miles north of its main campus.”

Tags: National Renewable Energy Laboratory, NREL, Photovoltaic Projects, Wind Energy

RSS Feed

RSS Feed